Authors

Summary

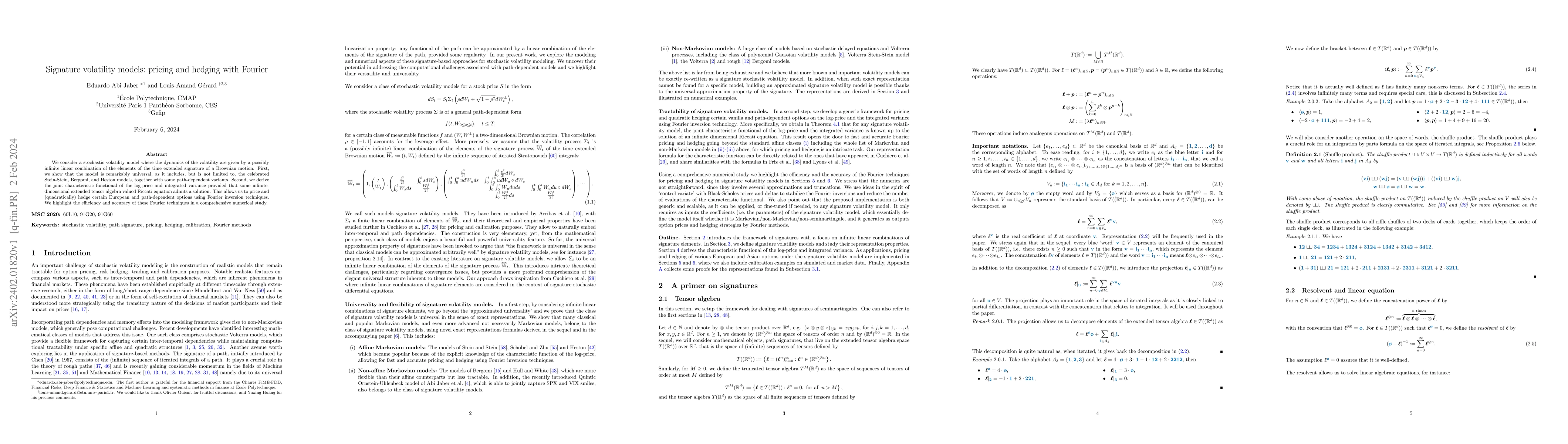

We consider a stochastic volatility model where the dynamics of the volatility are given by a possibly infinite linear combination of the elements of the time extended signature of a Brownian motion. First, we show that the model is remarkably universal, as it includes, but is not limited to, the celebrated Stein-Stein, Bergomi, and Heston models, together with some path-dependent variants. Second, we derive the joint characteristic functional of the log-price and integrated variance provided that some infinite dimensional extended tensor algebra valued Riccati equation admits a solution. This allows us to price and (quadratically) hedge certain European and path-dependent options using Fourier inversion techniques. We highlight the efficiency and accuracy of these Fourier techniques in a comprehensive numerical study.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)