Summary

In energy markets, joint historical and implied calibration is of paramount importance for practitioners yet notoriously challenging due to the need to align historical correlations of futures contracts with implied volatility smiles from the option market. We address this crucial problem with a parsimonious multiplicative multi-factor Heath-Jarrow-Morton (HJM) model for forward curves, combined with a stochastic volatility factor coming from the Lifted Heston model. We develop a sequential fast calibration procedure leveraging the Kemna-Vorst approximation of futures contracts: (i) historical correlations and the Variance Swap (VS) volatility term structure are captured through Level, Slope, and Curvature factors, (ii) the VS volatility term structure can then be corrected for a perfect match via a fixed-point algorithm, (iii) implied volatility smiles are calibrated using Fourier-based techniques. Our model displays remarkable joint historical and implied calibration fits - to both German power and TTF gas markets - and enables realistic interpolation within the implied volatility hypercube.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

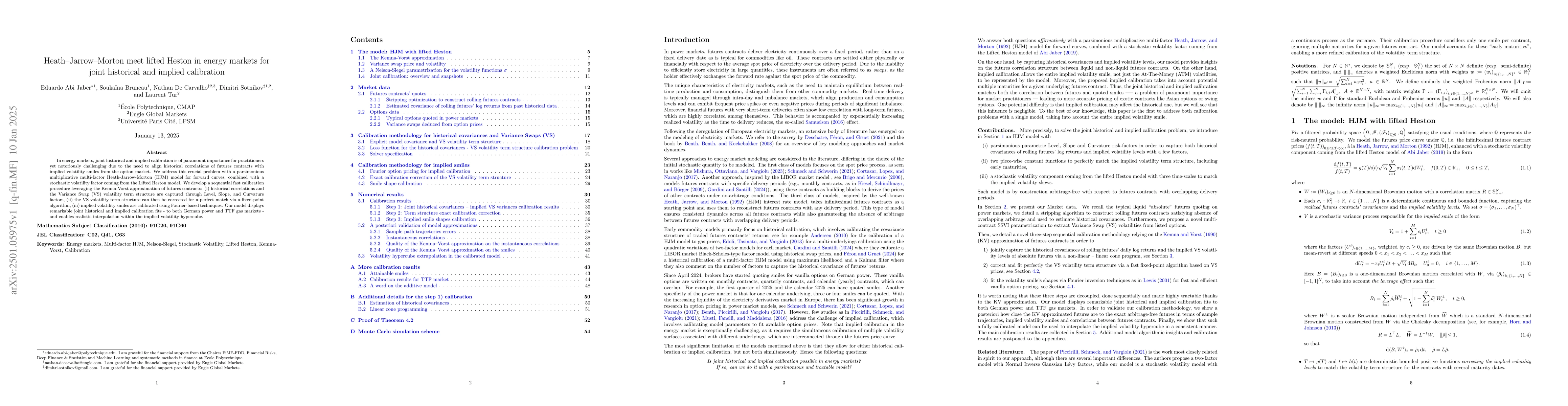

PDF Preview

Similar Papers

Found 4 papersA Heath-Jarrow-Morton framework for energy markets: a pragmatic approach

Matteo Gardini, Edoardo Santilli

No citations found for this paper.

Comments (0)