Authors

Summary

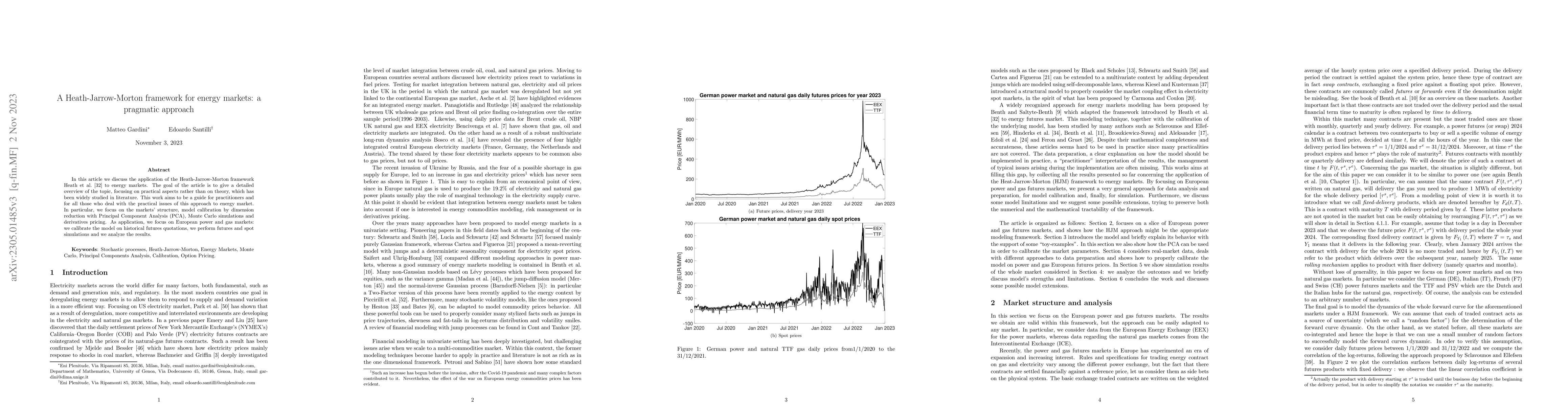

In this article we discuss the application of the Heath-Jarrow-Morton framework Heath et al. [26] to energy markets. The goal of the article is to give a detailed overview of the topic, focusing on practical aspects rather than on theory, which has been widely studied in literature. This work aims to be a guide for practitioners and for all those who deal with the practical issues of this approach to energy market. In particular, we focus on the markets' structure, model calibration by dimension reduction with Principal Component Analysis (PCA), Monte Carlo simulations and derivatives pricing. As application, we focus on European power and gas markets: we calibrate the model on historical futures quotations, we perform futures and spot simulations and we analyze the results.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersHeath-Jarrow-Morton meet lifted Heston in energy markets for joint historical and implied calibration

Eduardo Abi Jaber, Nathan De Carvalho, Soukaïna Bruneau et al.

No citations found for this paper.

Comments (0)