Summary

We introduce the Volterra Stein-Stein model with stochastic interest rates, where both volatility and interest rates are driven by correlated Gaussian Volterra processes. This framework unifies various well-known Markovian and non-Markovian models while preserving analytical tractability for pricing and hedging financial derivatives. We derive explicit formulas for pricing zero-coupon bond and interest rate cap or floor, along with a semi-explicit expression for the characteristic function of the log-forward index using Fredholm resolvents and determinants. This allows for fast and efficient derivative pricing and calibration via Fourier methods. We calibrate our model to market data and observe that our framework is flexible enough to capture key empirical features, such as the humped-shaped term structure of ATM implied volatilities for cap options and the concave ATM implied volatility skew term structure (in log-log scale) of the S&P 500 options. Finally, we establish connections between our characteristic function formula and expressions that depend on infinite-dimensional Riccati equations, thereby making the link with conventional linear-quadratic models.

AI Key Findings

Generated Jun 10, 2025

Methodology

The research introduces the Volterra Stein-Stein model with stochastic interest rates, utilizing correlated Gaussian Volterra processes for both volatility and interest rates, ensuring analytical tractability for pricing and hedging financial derivatives.

Key Results

- Explicit formulas for pricing zero-coupon bonds and interest rate caps or floors are derived.

- A semi-explicit expression for the characteristic function of the log-forward index is obtained using Fredholm resolvents and determinants.

- The model captures key empirical features like the humped-shaped term structure of ATM implied volatilities for cap options and the concave ATM implied volatility skew term structure of S&P 500 options.

- Connections are established between the characteristic function formula and expressions dependent on infinite-dimensional Riccati equations.

Significance

This work provides a unified framework for various Markovian and non-Markovian models, enabling fast and efficient derivative pricing and calibration via Fourier methods, which is crucial for practical applications in finance.

Technical Contribution

The paper presents a novel approach to model stochastic interest rates using Volterra processes, providing explicit pricing formulas and a characteristic function expression for efficient derivative pricing.

Novelty

The integration of Volterra processes into the Stein-Stein model offers a new perspective on stochastic interest rate modeling, combining analytical tractability with the flexibility to capture long-range dependencies observed in financial time series.

Limitations

- The model's performance in capturing extreme market events or fat tails is not explicitly discussed.

- The paper does not extensively compare the Volterra model's performance against other state-of-the-art models.

Future Work

- Investigate the model's performance in capturing extreme market events and tail risks.

- Conduct comparative studies with other advanced stochastic volatility models to validate its superiority in specific scenarios.

Paper Details

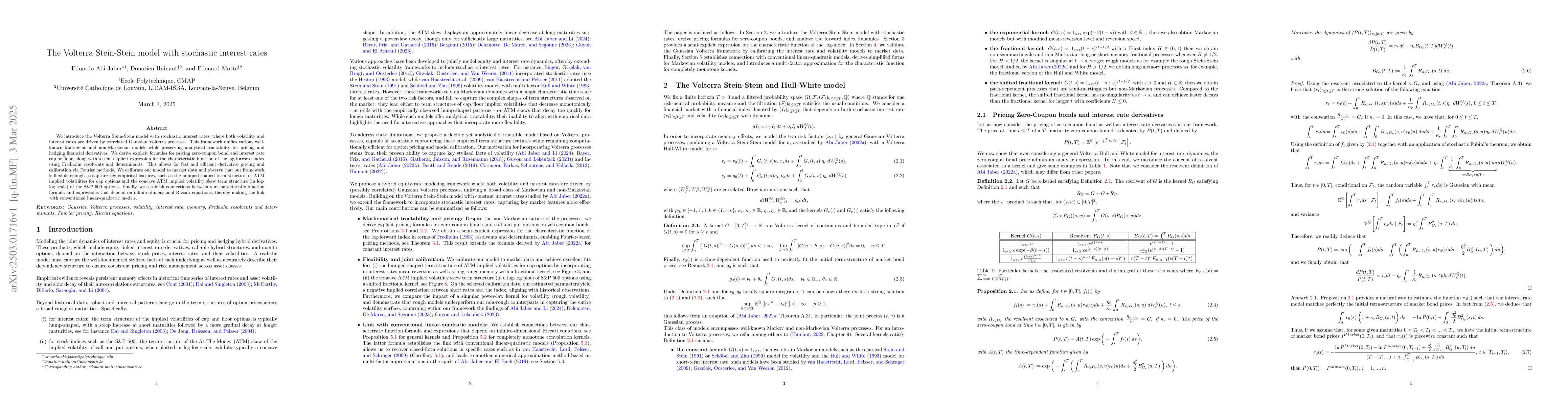

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)