Authors

Summary

We study complex discontinuities arising from the miscomputation of the Fourier-Laplace transform in the Volterra Stein-Stein model, which involves the complex square root of a Fredholm determinant. Discontinuities occur when the determinant crosses the negative real axis. We characterize these crossings for the joint Fourier-Laplace transform of the integrated variance and log-price. Additionally, we derive a corrected formula for the Fourier-Laplace transform and develop efficient numerical techniques to detect and compute these crossings. Applying our algorithms to Fourier-based pricing in the rough Stein-Stein model, we achieve a significant increase in accuracy while drastically reducing computational cost compared to existing methods.

AI Key Findings

Generated Jun 10, 2025

Methodology

The research employs a mathematical analysis of complex discontinuities in Fredholm determinants within the Volterra Stein-Stein model, utilizing Fourier-Laplace transforms and numerical techniques for efficient detection and computation of crossings.

Key Results

- Characterization of crossings for the joint Fourier-Laplace transform of integrated variance and log-price.

- Development of a corrected formula for the Fourier-Laplace transform.

- Introduction of efficient numerical algorithms for detecting and computing crossings.

- Demonstration of significant accuracy increase and reduced computational cost in Fourier-based pricing in the rough Stein-Stein model.

Significance

This study is significant as it addresses a critical issue in financial modeling, specifically in pricing derivatives under rough volatility models, by improving the accuracy and efficiency of Fourier-based methods.

Technical Contribution

The paper presents novel methods for handling complex discontinuities in Fredholm determinants, specifically focusing on the Volterra Stein-Stein model, and provides efficient numerical techniques for their computation.

Novelty

The research introduces a corrected formula for the Fourier-Laplace transform and efficient algorithms for detecting crossings, which markedly enhance the accuracy and computational efficiency of Fourier-based pricing in rough volatility models, distinguishing it from previous work that struggled with these challenges.

Limitations

- The analysis is confined to the Volterra Stein-Stein model and may not generalize directly to all stochastic volatility models.

- The paper does not explore the implications of the findings for other financial instruments beyond those examined.

Future Work

- Investigate the applicability of the developed algorithms to other stochastic volatility models and financial instruments.

- Explore the impact of these findings on real-world financial markets and risk management practices.

Paper Details

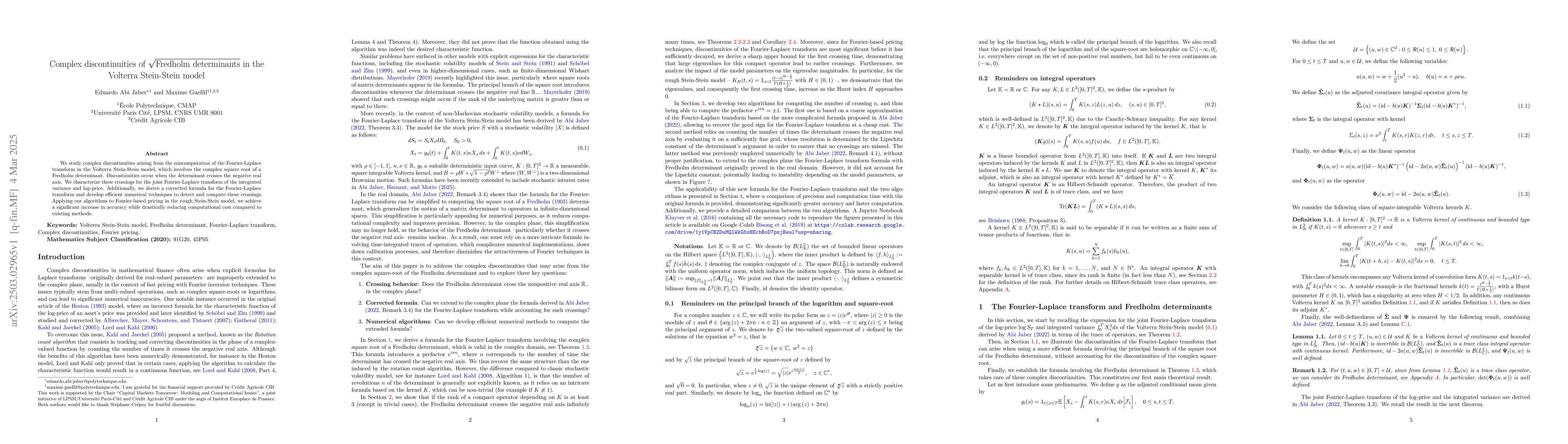

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe Volterra Stein-Stein model with stochastic interest rates

Eduardo Abi Jaber, Donatien Hainaut, Edouard Motte

No citations found for this paper.

Comments (0)