Summary

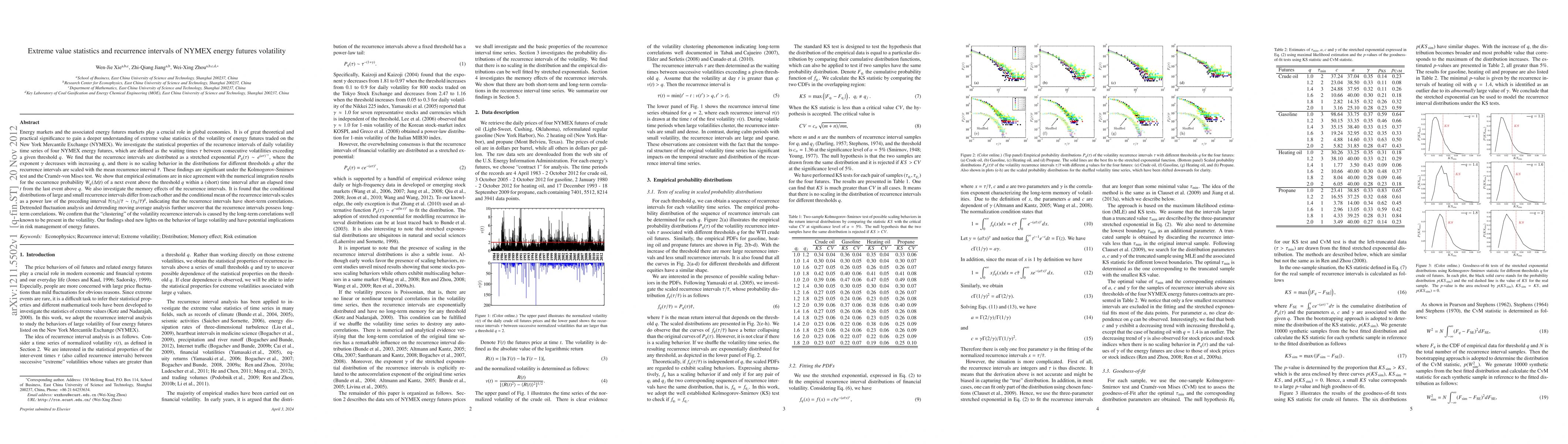

Energy markets and the associated energy futures markets play a crucial role in global economies. We investigate the statistical properties of the recurrence intervals of daily volatility time series of four NYMEX energy futures, which are defined as the waiting times $\tau$ between consecutive volatilities exceeding a given threshold $q$. We find that the recurrence intervals are distributed as a stretched exponential $P_q(\tau)\sim e^{(a\tau)^{-\gamma}}$, where the exponent $\gamma$ decreases with increasing $q$, and there is no scaling behavior in the distributions for different thresholds $q$ after the recurrence intervals are scaled with the mean recurrence interval $\bar\tau$. These findings are significant under the Kolmogorov-Smirnov test and the Cram{\'e}r-von Mises test. We show that empirical estimations are in nice agreement with the numerical integration results for the occurrence probability $W_q(\Delta{t}|t)$ of a next event above the threshold $q$ within a (short) time interval after an elapsed time $t$ from the last event above $q$. We also investigate the memory effects of the recurrence intervals. It is found that the conditional distributions of large and small recurrence intervals differ from each other and the conditional mean of the recurrence intervals scales as a power law of the preceding interval $\bar\tau(\tau_0)/\bar\tau \sim (\tau_0/\bar\tau)^\beta$, indicating that the recurrence intervals have short-term correlations. Detrended fluctuation analysis and detrending moving average analysis further uncover that the recurrence intervals possess long-term correlations. We confirm that the "clustering" of the volatility recurrence intervals is caused by the long-term correlations well known to be present in the volatility.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCOMEX Copper Futures Volatility Forecasting: Econometric Models and Deep Learning

Xinyi Lu, Zian Wang

Unique futures in China: studys on volatility spillover effects of ferrous metal futures

Tingting Cao, Lin Hao, Weiqing Sun et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)