Summary

We provide a near-optimal, computationally efficient algorithm for the unit-demand pricing problem, where a seller wants to price n items to optimize revenue against a unit-demand buyer whose values for the items are independently drawn from known distributions. For any chosen accuracy eps>0 and item values bounded in [0,1], our algorithm achieves revenue that is optimal up to an additive error of at most eps, in polynomial time. For values sampled from Monotone Hazard Rate (MHR) distributions, we achieve a (1-eps)-fraction of the optimal revenue in polynomial time, while for values sampled from regular distributions the same revenue guarantees are achieved in quasi-polynomial time. Our algorithm for bounded distributions applies probabilistic techniques to understand the statistical properties of revenue distributions, obtaining a reduction in the search space of the algorithm via dynamic programming. Adapting this approach to MHR and regular distributions requires the proof of novel extreme value theorems for such distributions. As a byproduct, our techniques establish structural properties of approximately-optimal and near-optimal solutions. We show that, for values independently distributed according to MHR distributions, pricing all items at the same price achieves a constant fraction of the optimal revenue. Moreover, for all eps >0, g(1/eps) distinct prices suffice to obtain a (1-eps)-fraction of the optimal revenue, where g(1/eps) is quadratic in 1/eps and independent of n. Similarly, for all eps>0 and n>0, at most g(1/(eps log n)) distinct prices suffice if the values are independently distributed according to regular distributions, where g() is a polynomial function. Finally, when the values are i.i.d. from some MHR distribution, we show that, if n is a sufficiently large function of 1/eps, a single price suffices to achieve a (1-eps)-fraction of the optimal revenue.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

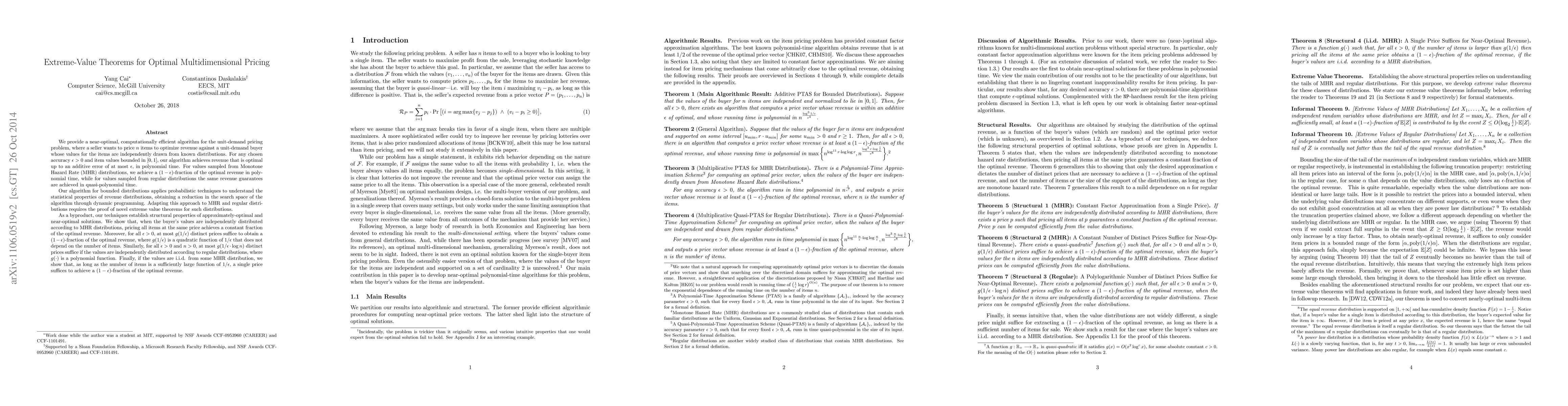

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)