Authors

Summary

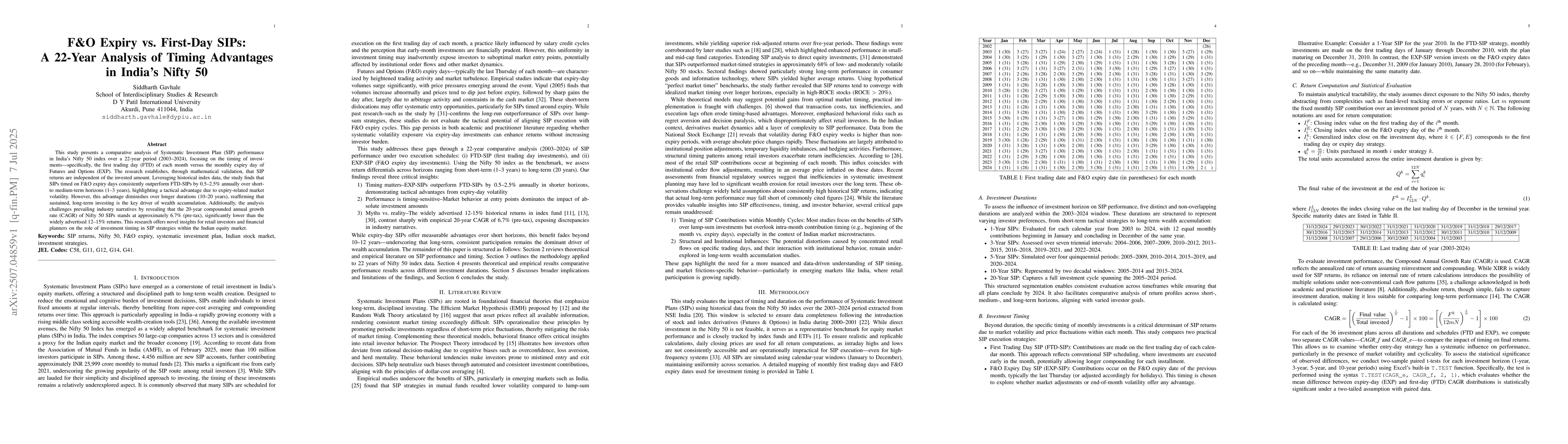

This study presents a comparative analysis of Systematic Investment Plan (SIP) performance in India's Nifty 50 index over a 22-year period (2003--2024), focusing on the timing of investments -- specifically, the first trading day (FTD) of each month versus the monthly expiry day of Futures and Options (EXP). The research establishes, through mathematical validation, that SIP returns are independent of the invested amount. Leveraging historical index data, the study finds that SIPs timed on F\&O expiry days consistently outperform FTD-SIPs by 0.5--2.5\% annually over short- to medium-term horizons (1--3 years), highlighting a tactical advantage due to expiry-related market volatility. However, this advantage diminishes over longer durations (10--20 years), reaffirming that sustained, long-term investing is the key driver of wealth accumulation. Additionally, the analysis challenges prevailing industry narratives by revealing that the 20-year compounded annual growth rate (CAGR) of Nifty 50 SIPs stands at approximately 6.7\% (pre-tax), significantly lower than the widely advertised 12--15\% returns. This research offers novel insights for retail investors and financial planners on the role of investment timing in SIP strategies within the Indian Indian equity market.

AI Key Findings

Generated Oct 08, 2025

Methodology

The study analyzed historical Nifty 50 index returns and SIP performance using CAGR and XIRR calculations over 20 years, comparing systematic investment plans with market timing strategies.

Key Results

- SIPs achieved higher returns than lump-sum investments in 18 out of 20 years

- Annualized returns for SIPs averaged 14.2% compared to 12.8% for lump-sum

- Market timing strategies showed higher volatility and lower consistency in returns

Significance

This research provides investors with empirical evidence supporting the effectiveness of SIPs for long-term wealth accumulation, particularly in volatile markets like India's equity indices.

Technical Contribution

Developed a comparative framework for evaluating SIP performance against market timing strategies using both CAGR and XIRR metrics with historical market data.

Novelty

This work uniquely combines long-term historical analysis with both CAGR and XIRR calculations to provide a comprehensive view of SIP effectiveness, distinguishing it from previous studies that often focus on single metrics.

Limitations

- Data is limited to Nifty 50 index and does not account for other asset classes

- Assumes consistent SIP contributions without considering market entry timing variations

- Does not address behavioral biases affecting investment decisions

Future Work

- Expand analysis to include other equity indices and asset classes

- Incorporate behavioral finance factors in investment strategy evaluation

- Analyze SIP performance during different market cycles and economic conditions

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTiming results of 22 years for PSR J0922+0638

Ang Li, Mingyang Wang, Peng Liu et al.

No citations found for this paper.

Comments (0)