Summary

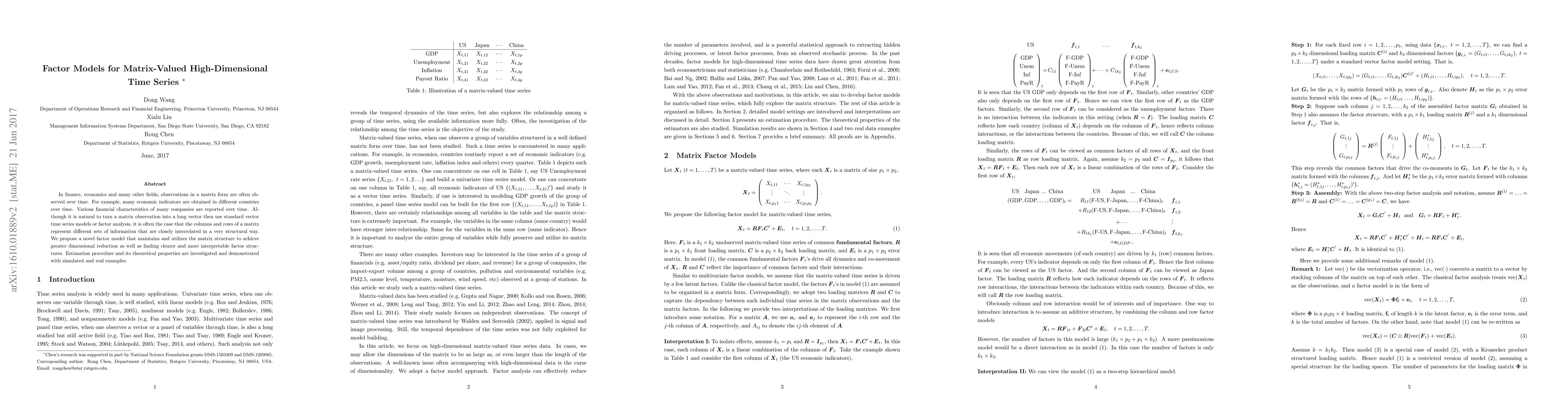

In finance, economics and many other fields, observations in a matrix form are often observed over time. For example, many economic indicators are obtained in different countries over time. Various financial characteristics of many companies are reported over time. Although it is natural to turn a matrix observation into a long vector then use standard vector time series models or factor analysis, it is often the case that the columns and rows of a matrix represent different sets of information that are closely interrelated in a very structural way. We propose a novel factor model that maintains and utilizes the matrix structure to achieve greater dimensional reduction as well as finding clearer and more interpretable factor structures. Estimation procedure and its theoretical properties are investigated and demonstrated with simulated and real examples.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDynamic Matrix Factor Models for High Dimensional Time Series

Han Xiao, Yuefeng Han, Rong Chen et al.

Factor Modelling for Biclustering Large-dimensional Matrix-valued Time Series

Yalin Wang, Yong He, Xiaoyang Ma et al.

Constrained Factor Models for High-Dimensional Matrix-Variate Time Series

Ruey S. Tsay, Rong Chen, Elynn Y. Chen

| Title | Authors | Year | Actions |

|---|

Comments (0)