Summary

Bielecki and Rutkowski (2014) introduced and studied a generic nonlinear market model, which includes several risky assets, multiple funding accounts and margin accounts. In this paper, we examine the pricing and hedging of contract both from the perspective of the hedger and the counterparty with arbitrary initial endowments. We derive inequalities for unilateral prices and we give the range for either fair bilateral prices or bilaterally profitable prices. We also study the monotonicity of a unilateral price with respect to the initial endowment. Our study hinges on results for BSDE driven by continuous martingales obtained in Nie and Rutkowski (2014), but we also derive the pricing PDEs for path-independent contingent claims of European style in a Markovian framework.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

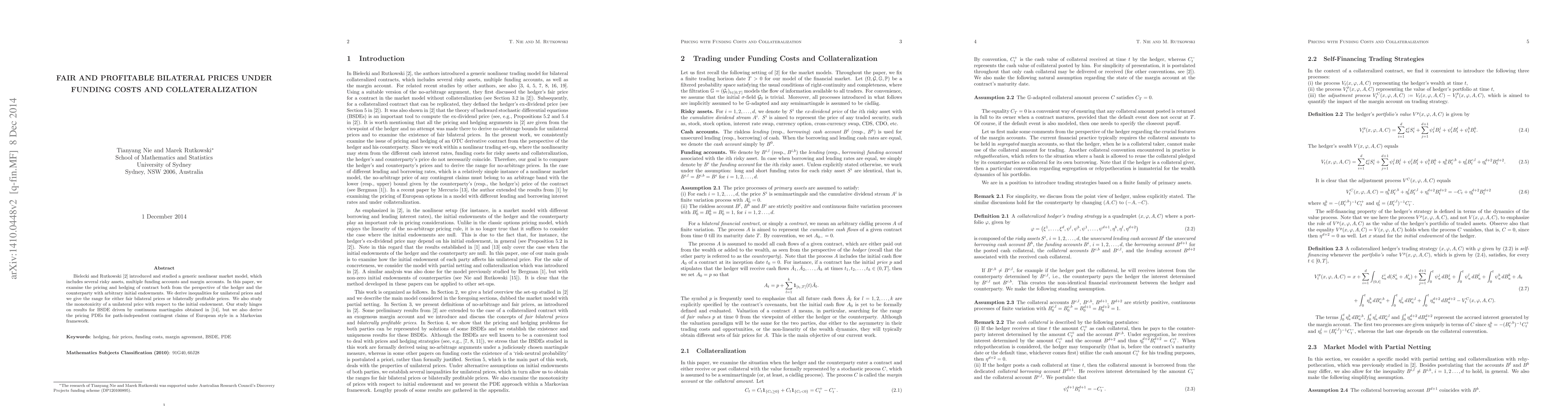

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)