Summary

Our previous results are extended to the case of the margin account, which may depend on the contract's value for the hedger and/or the counterparty. The present work generalizes also the papers by Bergman (1995), Mercurio (2013) and Piterbarg (2010). Using the comparison theorems for BSDEs, we derive inequalities for the unilateral prices and we give the range for its fair bilateral prices. We also establish results yielding the link to the market model with a single interest rate. In the case where the collateral amount is negotiated between the counterparties, so that it depends on their respective unilateral values, the backward stochastic viability property studied by Buckdahn et al. (2000) is used to derive the bounds on fair bilateral prices.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

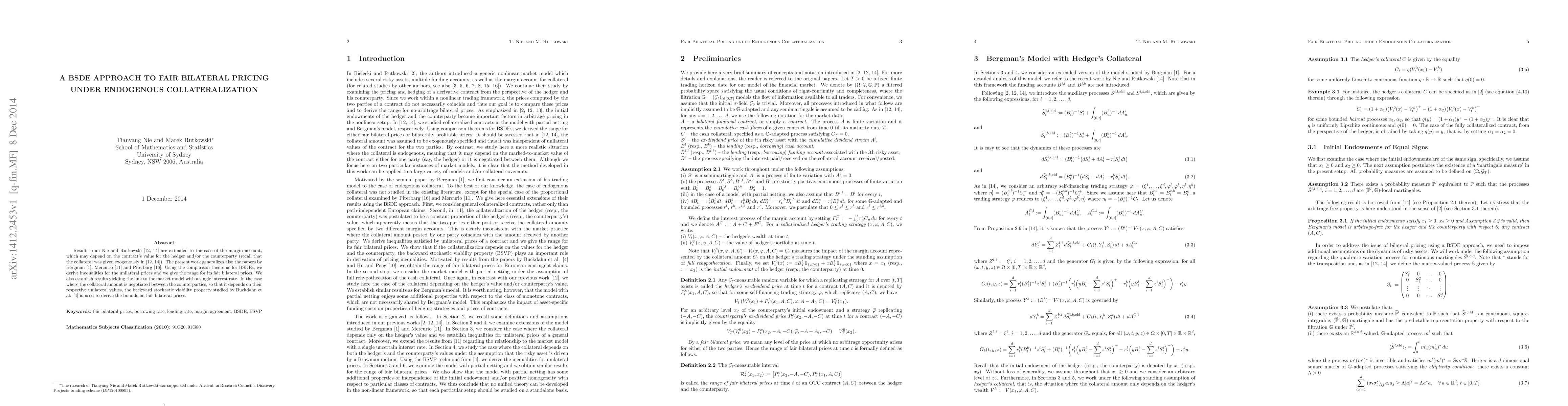

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)