Summary

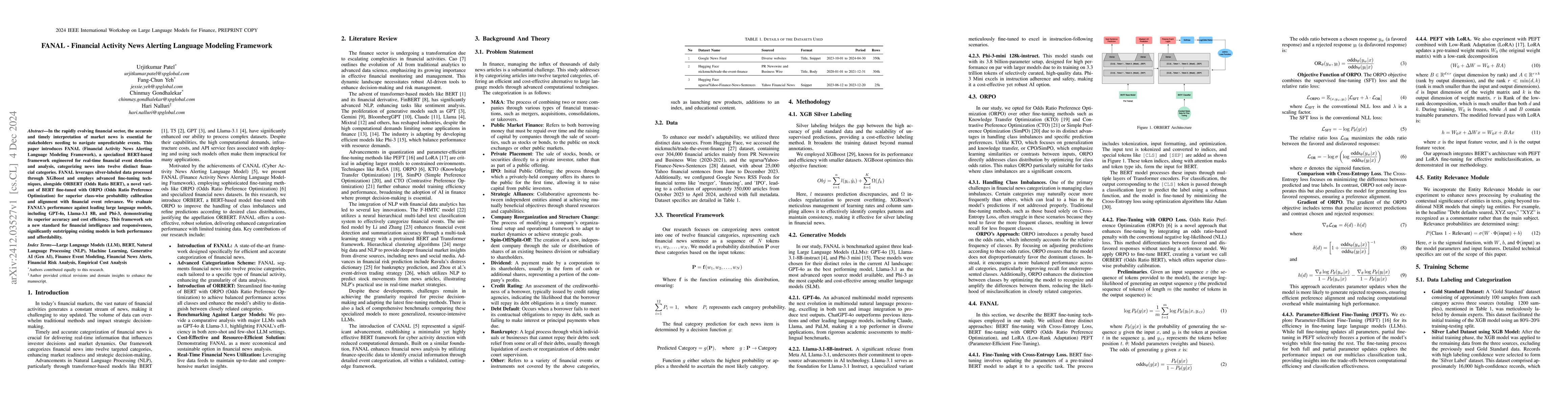

In the rapidly evolving financial sector, the accurate and timely interpretation of market news is essential for stakeholders needing to navigate unpredictable events. This paper introduces FANAL (Financial Activity News Alerting Language Modeling Framework), a specialized BERT-based framework engineered for real-time financial event detection and analysis, categorizing news into twelve distinct financial categories. FANAL leverages silver-labeled data processed through XGBoost and employs advanced fine-tuning techniques, alongside ORBERT (Odds Ratio BERT), a novel variant of BERT fine-tuned with ORPO (Odds Ratio Preference Optimization) for superior class-wise probability calibration and alignment with financial event relevance. We evaluate FANAL's performance against leading large language models, including GPT-4o, Llama-3.1 8B, and Phi-3, demonstrating its superior accuracy and cost efficiency. This framework sets a new standard for financial intelligence and responsiveness, significantly outstripping existing models in both performance and affordability.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCANAL -- Cyber Activity News Alerting Language Model: Empirical Approach vs. Expensive LLM

Urjitkumar Patel, Fang-Chun Yeh, Chinmay Gondhalekar

NIFTY Financial News Headlines Dataset

Frank Rudzicz, Raeid Saqur, Ken Kato et al.

Modeling News Interactions and Influence for Financial Market Prediction

Mengyu Wang, Shay B. Cohen, Tiejun Ma

No citations found for this paper.

Comments (0)