Authors

Summary

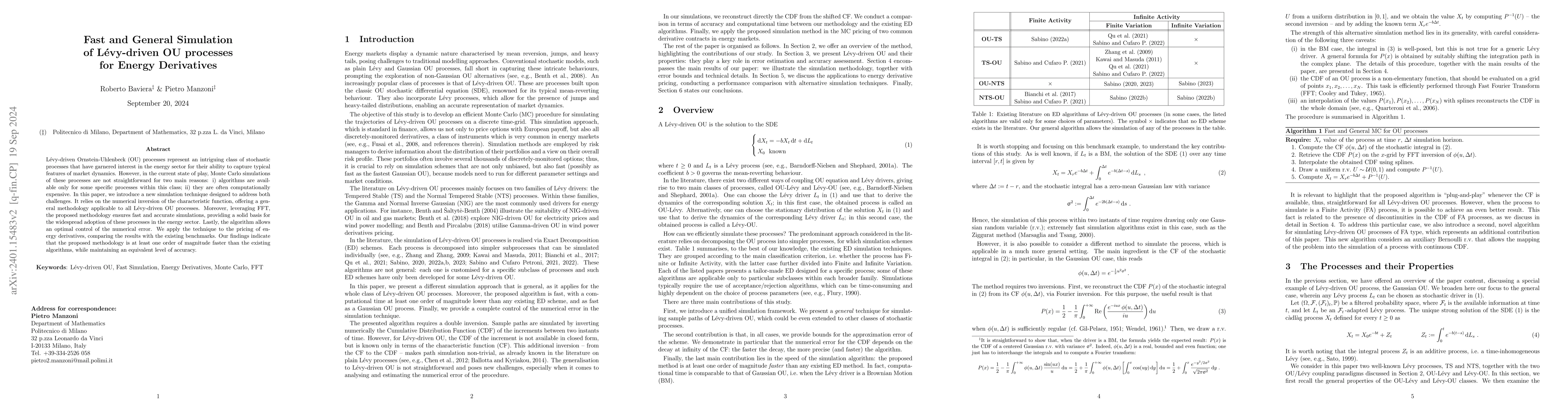

L\'evy-driven Ornstein-Uhlenbeck (OU) processes represent an intriguing class of stochastic processes that have garnered interest in the energy sector for their ability to capture typical features of market dynamics. However, in the current state-of-the-art, Monte Carlo simulations of these processes are not straightforward for two main reasons: i) algorithms are available only for some particular processes within this class; ii) they are often computationally expensive. In this paper, we introduce a new simulation technique designed to address both challenges. It relies on the numerical inversion of the characteristic function, offering a general methodology applicable to all L\'evy-driven OU processes. Moreover, leveraging FFT, the proposed methodology ensures fast and accurate simulations, providing a solid basis for the widespread adoption of these processes in the energy sector. Lastly, the algorithm allows an optimal control of the numerical error. We apply the technique to the pricing of energy derivatives, comparing the results with existing benchmarks. Our findings indicate that the proposed methodology is at least one order of magnitude faster than existing algorithms, all while maintaining an equivalent level of accuracy.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersConvergence rates for Backward SDEs driven by L\'evy processes

Chenguang Liu, Antonis Papapantoleon, Alexandros Saplaouras

No citations found for this paper.

Comments (0)