Authors

Summary

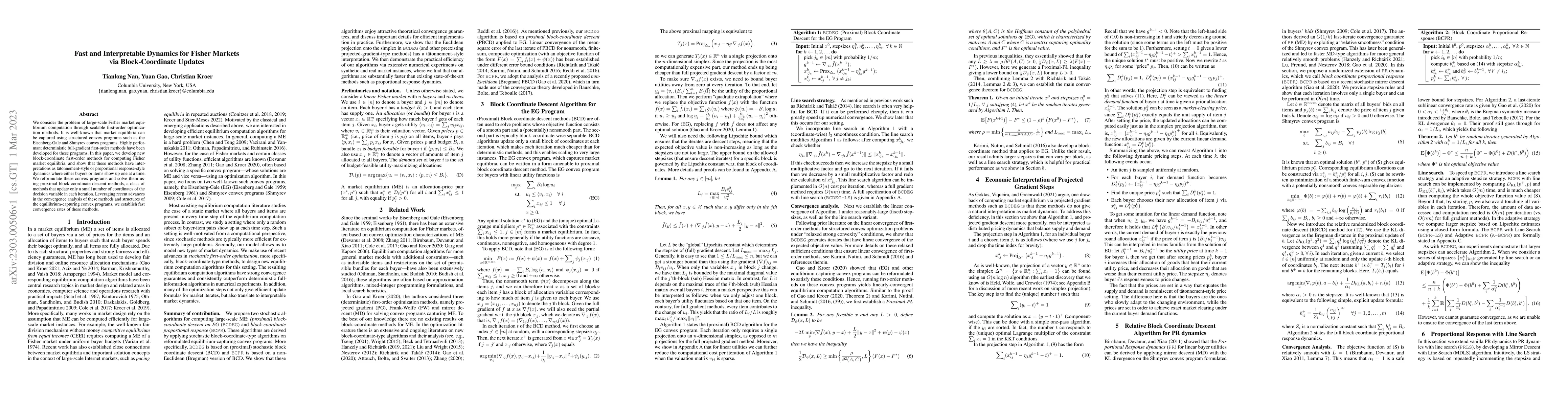

We consider the problem of large-scale Fisher market equilibrium computation through scalable first-order optimization methods. It is well-known that market equilibria can be captured using structured convex programs such as the Eisenberg-Gale and Shmyrev convex programs. Highly performant deterministic full-gradient first-order methods have been developed for these programs. In this paper, we develop new block-coordinate first-order methods for computing Fisher market equilibria, and show that these methods have interpretations as t\^atonnement-style or proportional response-style dynamics where either buyers or items show up one at a time. We reformulate these convex programs and solve them using proximal block coordinate descent methods, a class of methods that update only a small number of coordinates of the decision variable in each iteration. Leveraging recent advances in the convergence analysis of these methods and structures of the equilibrium-capturing convex programs, we establish fast convergence rates of these methods.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)