Summary

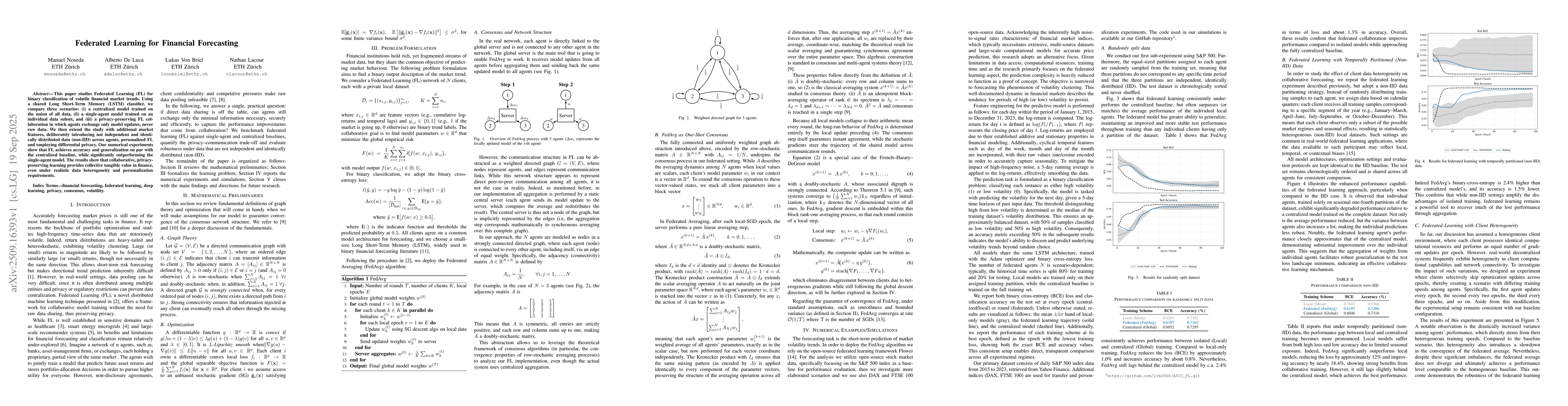

This paper studies Federated Learning (FL) for binary classification of volatile financial market trends. Using a shared Long Short-Term Memory (LSTM) classifier, we compare three scenarios: (i) a centralized model trained on the union of all data, (ii) a single-agent model trained on an individual data subset, and (iii) a privacy-preserving FL collaboration in which agents exchange only model updates, never raw data. We then extend the study with additional market features, deliberately introducing not independent and identically distributed data (non-IID) across agents, personalized FL and employing differential privacy. Our numerical experiments show that FL achieves accuracy and generalization on par with the centralized baseline, while significantly outperforming the single-agent model. The results show that collaborative, privacy-preserving learning provides collective tangible value in finance, even under realistic data heterogeneity and personalization requirements.

AI Key Findings

Generated Sep 30, 2025

Methodology

The study employs Federated Learning (FL) to perform binary classification of financial market trends using a shared LSTM classifier. Three scenarios are compared: centralized model training on aggregated data, single-agent models on individual data subsets, and privacy-preserving FL collaboration exchanging only model updates. The research extends to non-IID data, personalized FL, and differential privacy.

Key Results

- FL achieves accuracy and generalization comparable to centralized models while preserving privacy.

- FL significantly outperforms single-agent models in accuracy and robustness, especially under non-IID data conditions.

- Personalized FL demonstrates effective knowledge transfer to new, unseen financial markets with minimal additional training.

Significance

This research demonstrates that collaborative, privacy-preserving learning provides tangible value in finance, even with data heterogeneity and personalization requirements. It offers a practical framework for financial institutions to leverage distributed data without compromising privacy.

Technical Contribution

The paper provides a systematic analysis of FL in financial forecasting, including theoretical insights into consensus mechanisms, handling non-IID data, and incorporating differential privacy while maintaining model performance.

Novelty

The work introduces a comprehensive study of FL in financial contexts with realistic data heterogeneity, personalization requirements, and privacy constraints, demonstrating its effectiveness through extensive numerical experiments on financial time series data.

Limitations

- Strong differential privacy guarantees can severely degrade model performance if not properly tuned.

- Additional data volume beyond a certain point does not yield further performance gains for either individual clients or federated models.

Future Work

- Investigating optimal privacy-utility trade-offs using differential privacy techniques

- Exploring robust aggregation techniques to handle adversarial or faulty clients

- Developing more complex forecasting models using richer, yet harder-to-access data sources

Paper Details

PDF Preview

Similar Papers

Found 5 papersFederated Learning for 5G Base Station Traffic Forecasting

Nikolaos Pavlidis, Vasileios Perifanis, Pavlos S. Efraimidis et al.

Privacy-preserving Federated Learning for Residential Short Term Load Forecasting

Gilbert Fridgen, Joaquin Delgado Fernandez, Sergio Potenciano Menci et al.

Comments (0)