Summary

This research paper explores the performance of Machine Learning (ML) algorithms and techniques that can be used for financial asset price forecasting. The prediction and forecasting of asset prices and returns remains one of the most challenging and exciting problems for quantitative finance and practitioners alike. The massive increase in data generated and captured in recent years presents an opportunity to leverage Machine Learning algorithms. This study directly compares and contrasts state-of-the-art implementations of modern Machine Learning algorithms on high performance computing (HPC) infrastructures versus the traditional and highly popular Capital Asset Pricing Model (CAPM) on U.S equities data. The implemented Machine Learning models - trained on time series data for an entire stock universe (in addition to exogenous macroeconomic variables) significantly outperform the CAPM on out-of-sample (OOS) test data.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

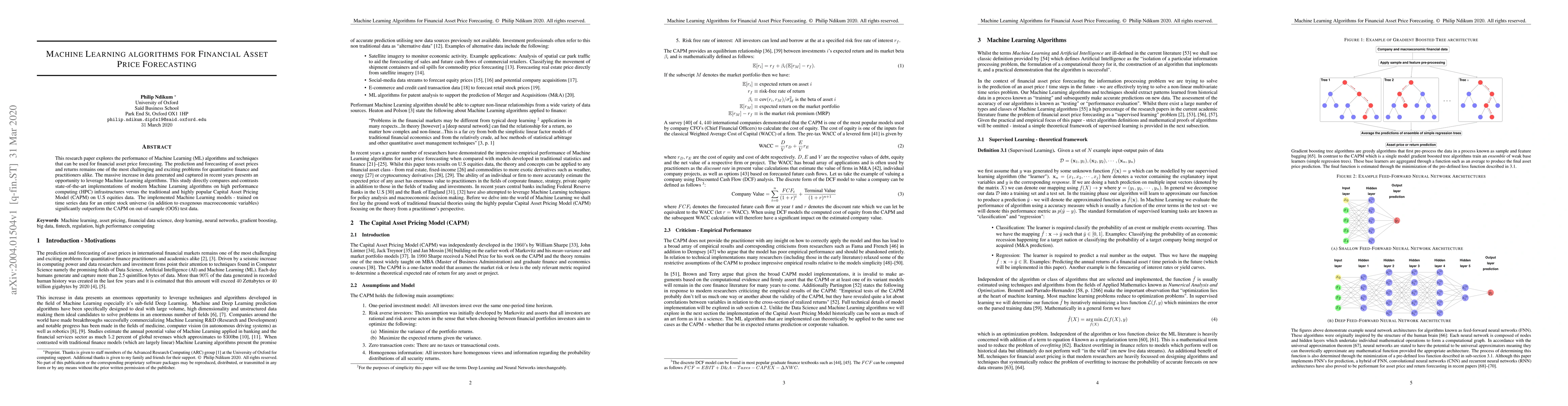

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBenchmarking Automated Machine Learning Methods for Price Forecasting Applications

Dennis Klau, Christian Tutschku, Marc-André Zöller et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)