Summary

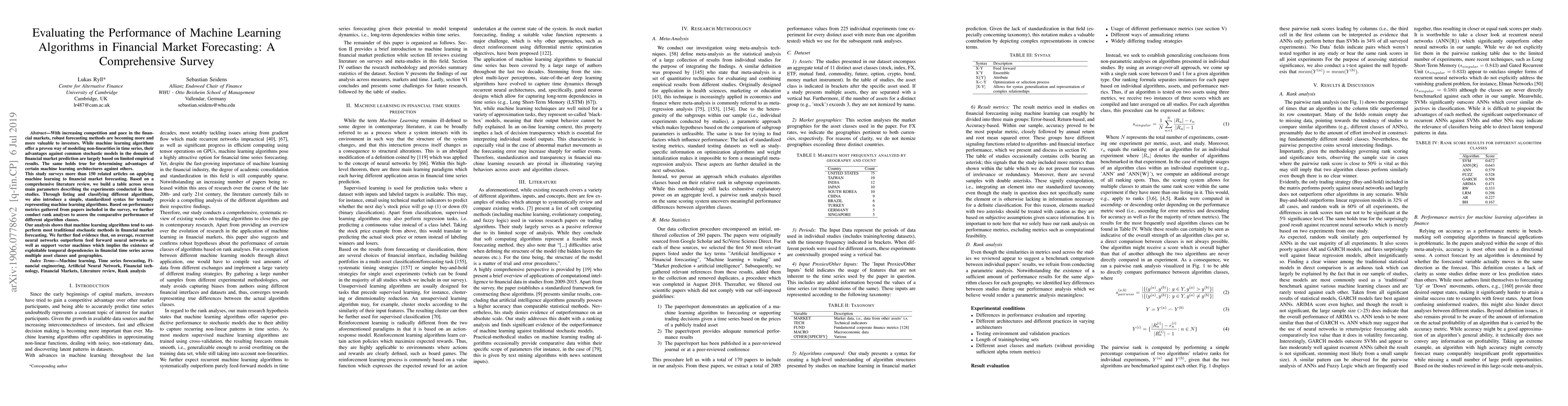

With increasing competition and pace in the financial markets, robust forecasting methods are becoming more and more valuable to investors. While machine learning algorithms offer a proven way of modeling non-linearities in time series, their advantages against common stochastic models in the domain of financial market prediction are largely based on limited empirical results. The same holds true for determining advantages of certain machine learning architectures against others. This study surveys more than 150 related articles on applying machine learning to financial market forecasting. Based on a comprehensive literature review, we build a table across seven main parameters describing the experiments conducted in these studies. Through listing and classifying different algorithms, we also introduce a simple, standardized syntax for textually representing machine learning algorithms. Based on performance metrics gathered from papers included in the survey, we further conduct rank analyses to assess the comparative performance of different algorithm classes. Our analysis shows that machine learning algorithms tend to outperform most traditional stochastic methods in financial market forecasting. We further find evidence that, on average, recurrent neural networks outperform feed forward neural networks as well as support vector machines which implies the existence of exploitable temporal dependencies in financial time series across multiple asset classes and geographies.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)