Summary

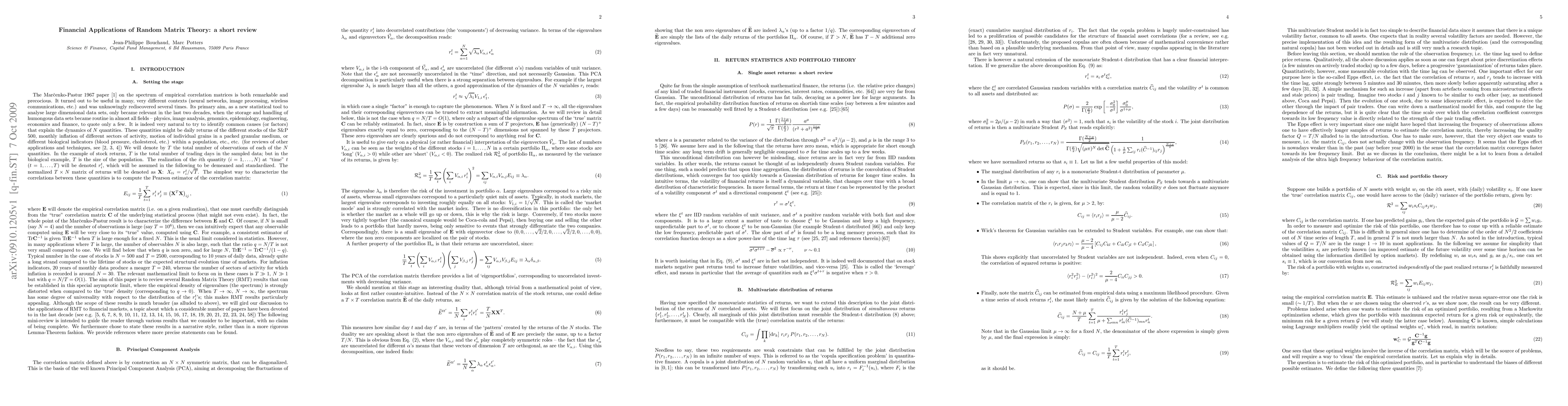

We discuss the applications of Random Matrix Theory in the context of financial markets and econometric models, a topic about which a considerable number of papers have been devoted to in the last decade. This mini-review is intended to guide the reader through various theoretical results (the Marcenko-Pastur spectrum and its various generalisations, random SVD, free matrices, largest eigenvalue statistics, etc.) as well as some concrete applications to portfolio optimisation and out-of-sample risk estimation.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)