Summary

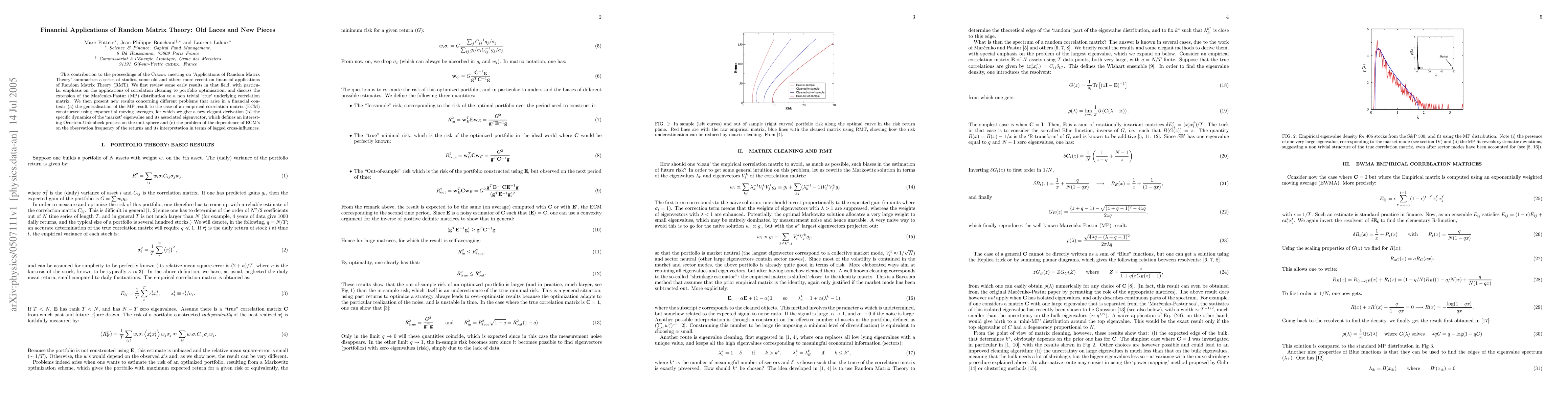

This contribution to the proceedings of the Cracow meeting on `Applications of Random Matrix Theory' summarizes a series of studies, some old and others more recent on financial applications of Random Matrix Theory (RMT). We first review some early results in that field, with particular emphasis on the applications of correlation cleaning to portfolio optimisation, and discuss the extension of the Marcenko-Pastur (MP) distribution to a non trivial `true' underlying correlation matrix. We then present new results concerning different problems that arise in a financial context: (a) the generalisation of the MP result to the case of an empirical correlation matrix (ECM) constructed using exponential moving averages, for which we give a new elegant derivation (b) the specific dynamics of the `market' eigenvalue and its associated eigenvector, which defines an interesting Ornstein-Uhlenbeck process on the unit sphere and (c) the problem of the dependence of ECM's on the observation frequency of the returns and its interpretation in terms of lagged cross-influences.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Comments (0)