Summary

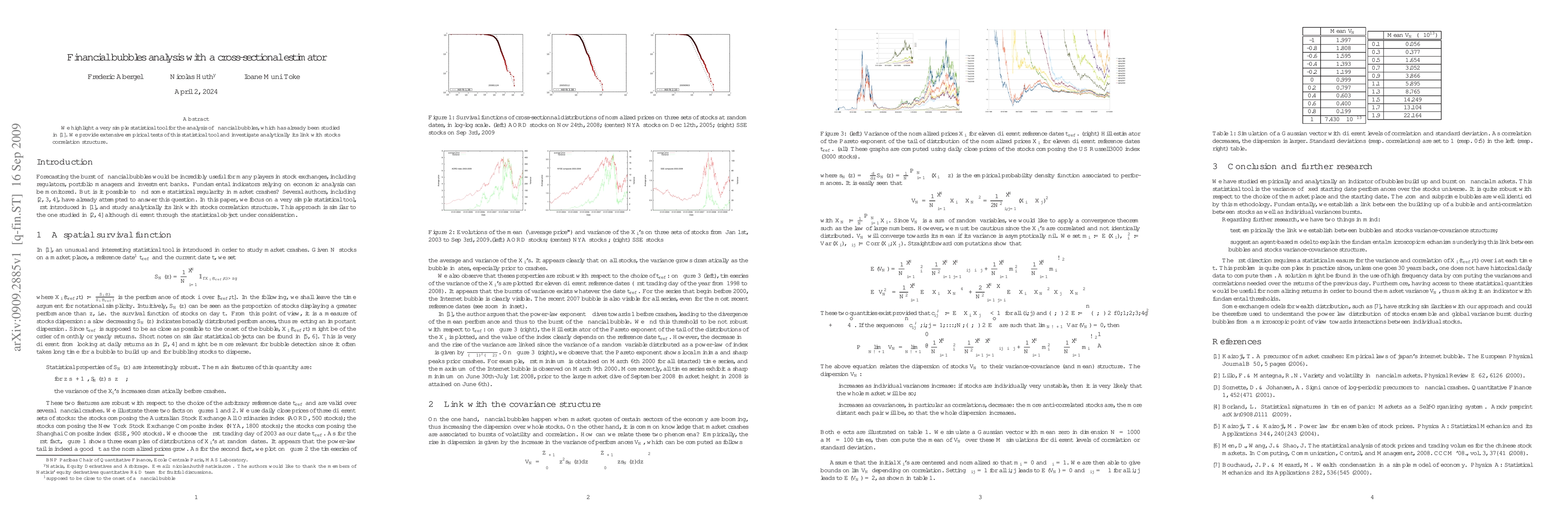

We highlight a very simple statistical tool for the analysis of financial bubbles, which has already been studied in [1]. We provide extensive empirical tests of this statistical tool and investigate analytically its link with stocks correlation structure.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersWhy Topological Data Analysis Detects Financial Bubbles?

Matteo Manzi, Vahid Nateghi, Marian Gidea et al.

The Cross-Sectional Intrinsic Entropy. A Comprehensive Stock Market Volatility Estimator

Marcel Ausloos, Claudiu Vinte

| Title | Authors | Year | Actions |

|---|

Comments (0)