Authors

Summary

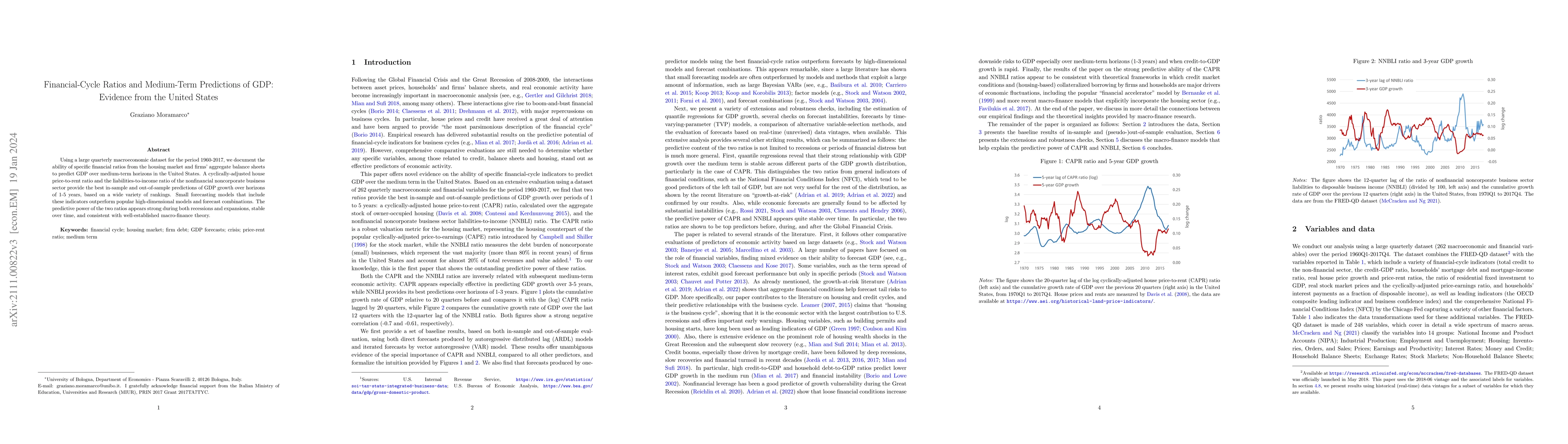

Using a large quarterly macroeconomic dataset for the period 1960-2017, we document the ability of specific financial ratios from the housing market and firms' aggregate balance sheets to predict GDP over medium-term horizons in the United States. A cyclically adjusted house price-to-rent ratio and the liabilities-to-income ratio of the non-financial non-corporate business sector provide the best in-sample and out-of-sample predictions of GDP growth over horizons of one to five years, based on a wide variety of rankings. Small forecasting models that include these indicators outperform popular high-dimensional models and forecast combinations. The predictive power of the two ratios appears strong during both recessions and expansions, stable over time, and consistent with well-established macro-finance theory.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersForecasting Climate Policy Uncertainty: Evidence from the United States

Tanujit Chakraborty, Donia Besher, Anirban Sengupta

The Endurance of Identity-Based Voting: Evidence from the United States and Comparative Democracies

Venkat Ram Reddy Ganuthula, Krishna Kumar Balaraman

| Title | Authors | Year | Actions |

|---|

Comments (0)