Authors

Summary

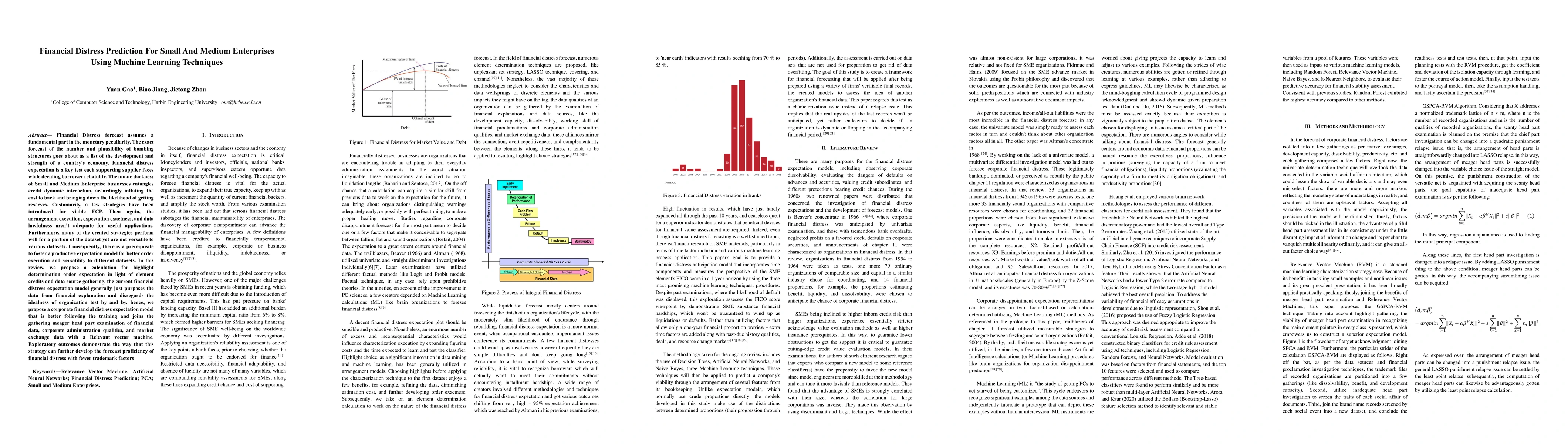

Financial Distress Prediction plays a crucial role in the economy by accurately forecasting the number and probability of failing structures, providing insight into the growth and stability of a country's economy. However, predicting financial distress for Small and Medium Enterprises is challenging due to their inherent ambiguity, leading to increased funding costs and decreased chances of receiving funds. While several strategies have been developed for effective FCP, their implementation, accuracy, and data security fall short of practical applications. Additionally, many of these strategies perform well for a portion of the dataset but are not adaptable to various datasets. As a result, there is a need to develop a productive prediction model for better order execution and adaptability to different datasets. In this review, we propose a feature selection algorithm for FCP based on element credits and data source collection. Current financial distress prediction models rely mainly on financial statements and disregard the timeliness of organization tests. Therefore, we propose a corporate FCP model that better aligns with industry practice and incorporates the gathering of thin-head component analysis of financial data, corporate governance qualities, and market exchange data with a Relevant Vector Machine. Experimental results demonstrate that this strategy can improve the forecast efficiency of financial distress with fewer characteristic factors.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBank Loan Prediction Using Machine Learning Techniques

Md. Mahedi Hassan, F M Ahosanul Haque

No citations found for this paper.

Comments (0)