Authors

Summary

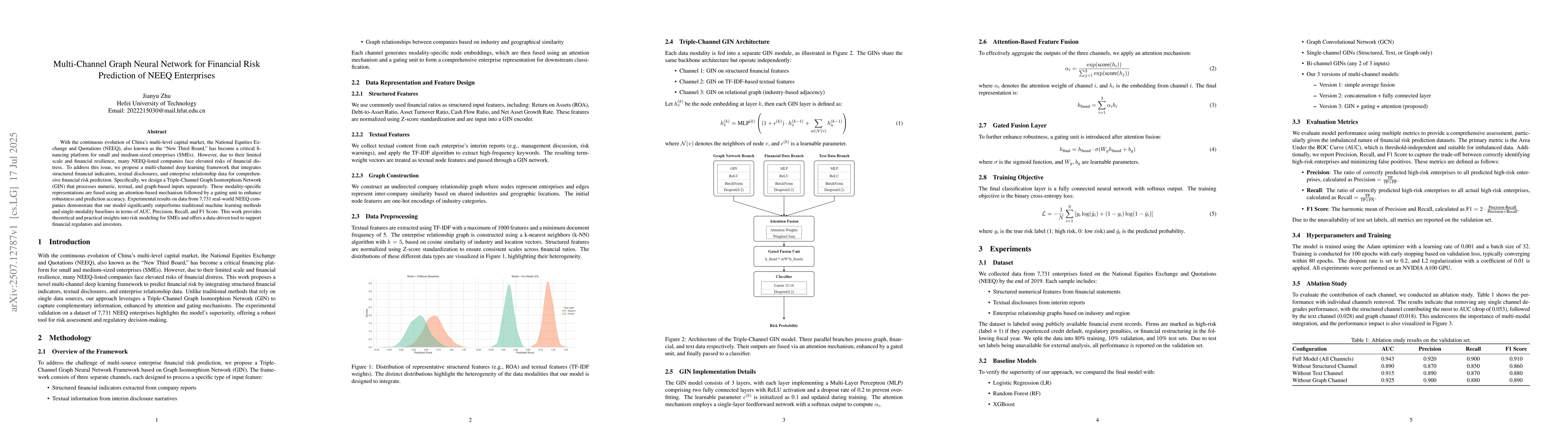

With the continuous evolution of China's multi-level capital market, the National Equities Exchange and Quotations (NEEQ), also known as the "New Third Board," has become a critical financing platform for small and medium-sized enterprises (SMEs). However, due to their limited scale and financial resilience, many NEEQ-listed companies face elevated risks of financial distress. To address this issue, we propose a multi-channel deep learning framework that integrates structured financial indicators, textual disclosures, and enterprise relationship data for comprehensive financial risk prediction. Specifically, we design a Triple-Channel Graph Isomorphism Network (GIN) that processes numeric, textual, and graph-based inputs separately. These modality-specific representations are fused using an attention-based mechanism followed by a gating unit to enhance robustness and prediction accuracy. Experimental results on data from 7,731 real-world NEEQ companies demonstrate that our model significantly outperforms traditional machine learning methods and single-modality baselines in terms of AUC, Precision, Recall, and F1 Score. This work provides theoretical and practical insights into risk modeling for SMEs and offers a data-driven tool to support financial regulators and investors.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCombining Intra-Risk and Contagion Risk for Enterprise Bankruptcy Prediction Using Graph Neural Networks

Qing Li, Ji Liu, Yu Zhao et al.

Temporal and Heterogeneous Graph Neural Network for Financial Time Series Prediction

Ying Zhang, Dawei Cheng, Sheng Xiang et al.

Financial Default Prediction via Motif-preserving Graph Neural Network with Curriculum Learning

Zhiqiang Zhang, Jun Zhou, Daixin Wang et al.

No citations found for this paper.

Comments (0)