Summary

In this work, we demonstrate how to apply non-linear cardinality constraints, important for real-world asset management, to quantum portfolio optimization. This enables us to tackle non-convex portfolio optimization problems using quantum annealing that would otherwise be challenging for classical algorithms. Being able to use cardinality constraints for portfolio optimization opens the doors to new applications for creating innovative portfolios and exchange-traded-funds (ETFs). We apply the methodology to the practical problem of enhanced index tracking and are able to construct smaller portfolios that significantly outperform the risk profile of the target index whilst retaining high degrees of tracking.

AI Key Findings

Generated Sep 06, 2025

Methodology

Quantum computing is used to solve non-linearly constrained optimization problems with cardinality constraints

Key Results

- Smaller portfolios can capture target index returns

- Enhanced index tracking outperforms risk profile of target index

- Improved portfolio construction using quantum computing

Significance

This research demonstrates the potential of quantum computing for practical finance applications

Technical Contribution

Development of a quantum computing-based optimization framework for portfolio construction

Novelty

Application of cardinality constraints to portfolio optimization, enabling smaller and more efficient portfolios

Limitations

- Limited to NAsDAQ-100 and S¼P500 indexes

- Assumes no transaction costs or dividend reinvestment

Future Work

- Enhance model with additional constraints or asset types

- Explore application to other financial markets or instruments

Paper Details

PDF Preview

Key Terms

Citation Network

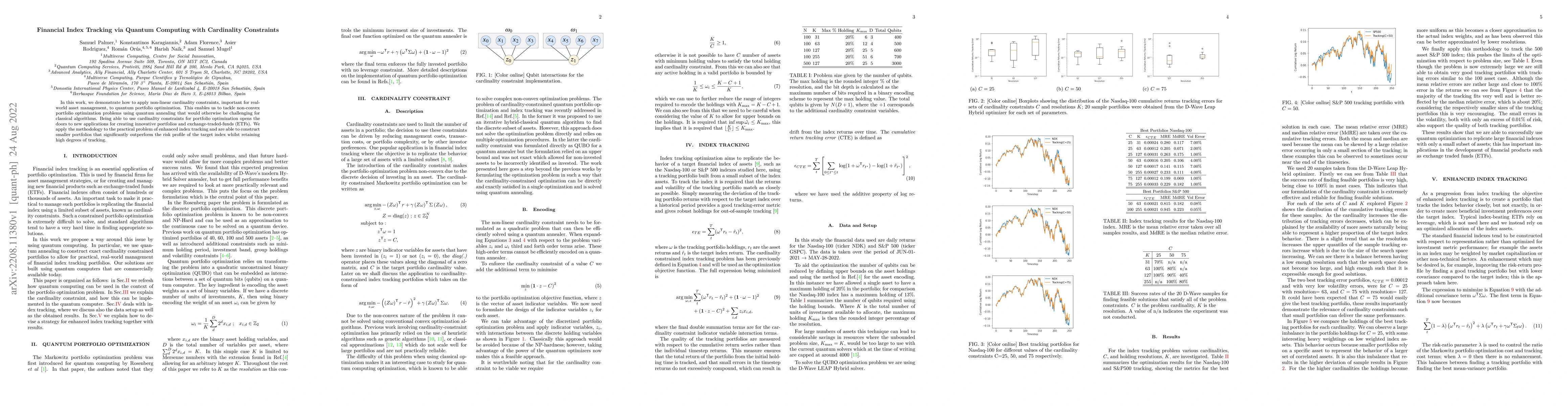

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDCC: Differentiable Cardinality Constraints for Partial Index Tracking

Hyunsouk Cho, Wooyeon Jo

Asset pre-selection for a cardinality constrained index tracking portfolio with optional enhancement

J. E. Beasley, N. Meade, C. A. Valle

| Title | Authors | Year | Actions |

|---|

Comments (0)