Samuel Mugel

17 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

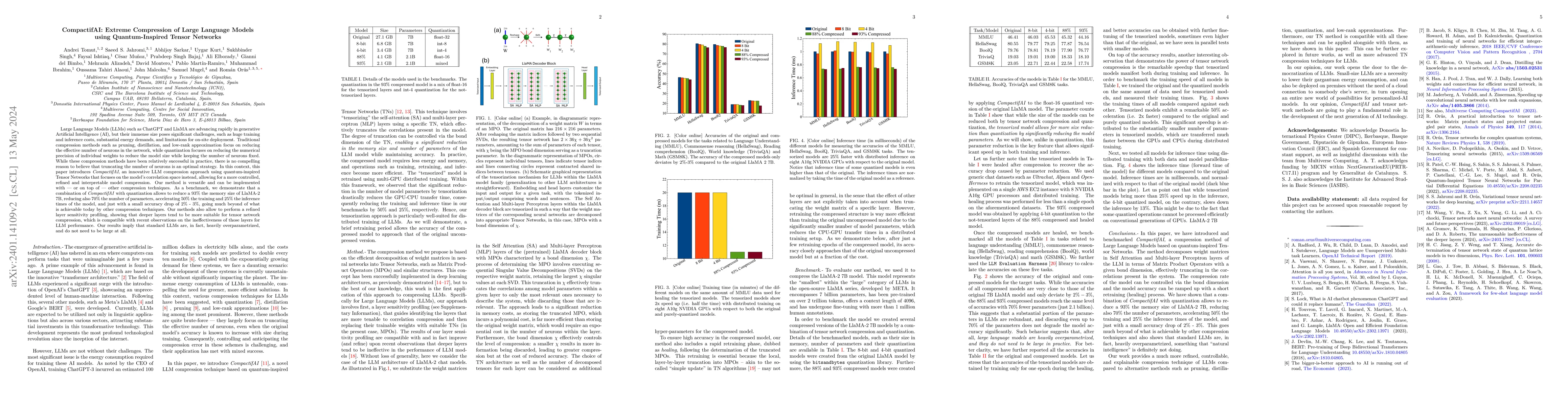

CompactifAI: Extreme Compression of Large Language Models using Quantum-Inspired Tensor Networks

Large Language Models (LLMs) such as ChatGPT and LlaMA are advancing rapidly in generative Artificial Intelligence (AI), but their immense size poses significant challenges, such as huge training an...

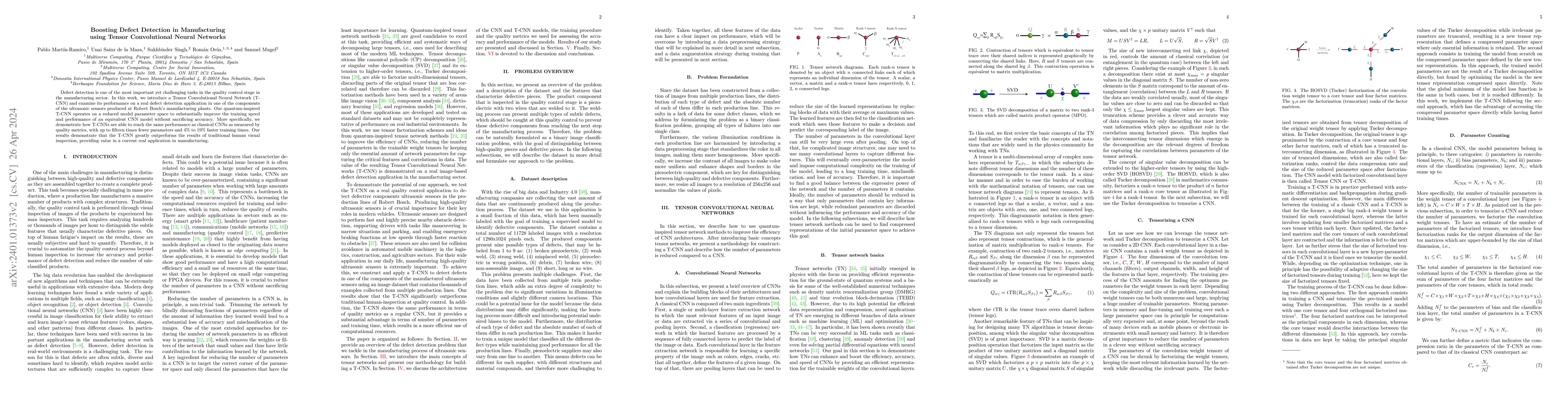

Boosting Defect Detection in Manufacturing using Tensor Convolutional Neural Networks

Defect detection is one of the most important yet challenging tasks in the quality control stage in the manufacturing sector. In this work, we introduce a Tensor Convolutional Neural Network (T-CNN)...

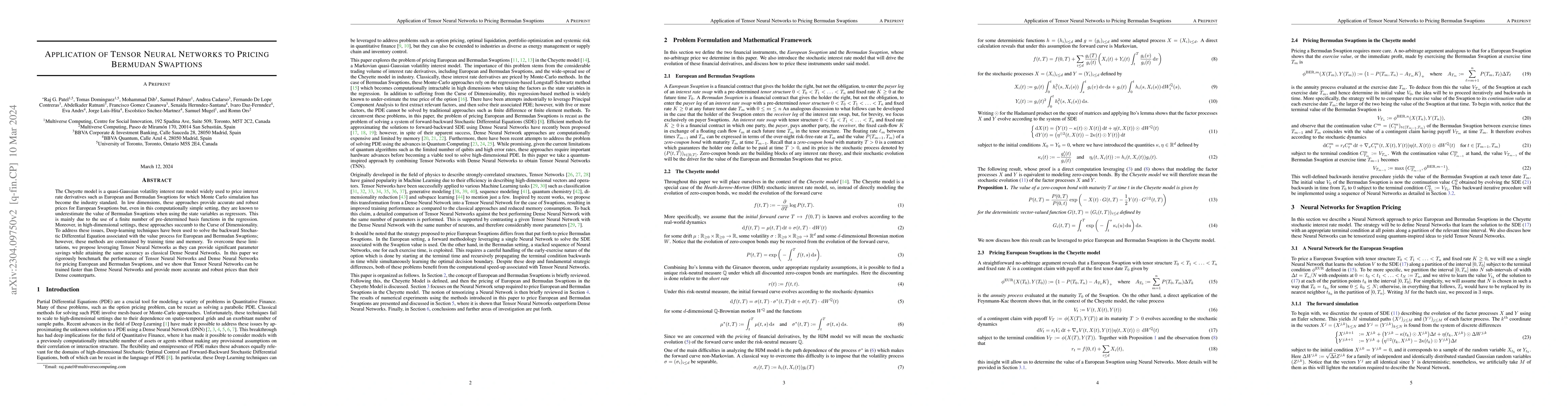

Application of Tensor Neural Networks to Pricing Bermudan Swaptions

The Cheyette model is a quasi-Gaussian volatility interest rate model widely used to price interest rate derivatives such as European and Bermudan Swaptions for which Monte Carlo simulation has beco...

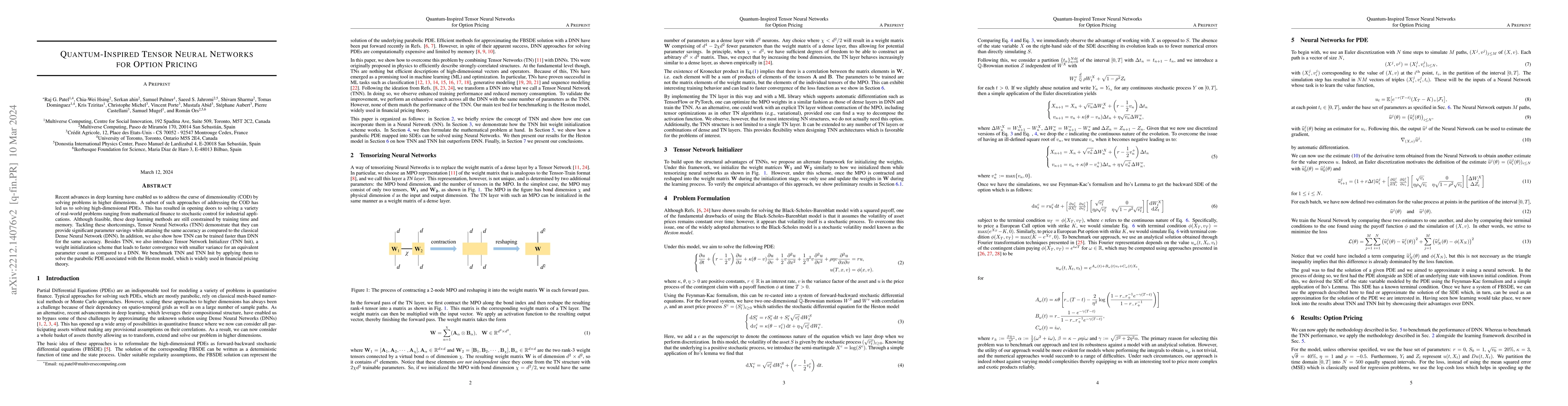

Quantum-Inspired Tensor Neural Networks for Option Pricing

Recent advances in deep learning have enabled us to address the curse of dimensionality (COD) by solving problems in higher dimensions. A subset of such approaches of addressing the COD has led us t...

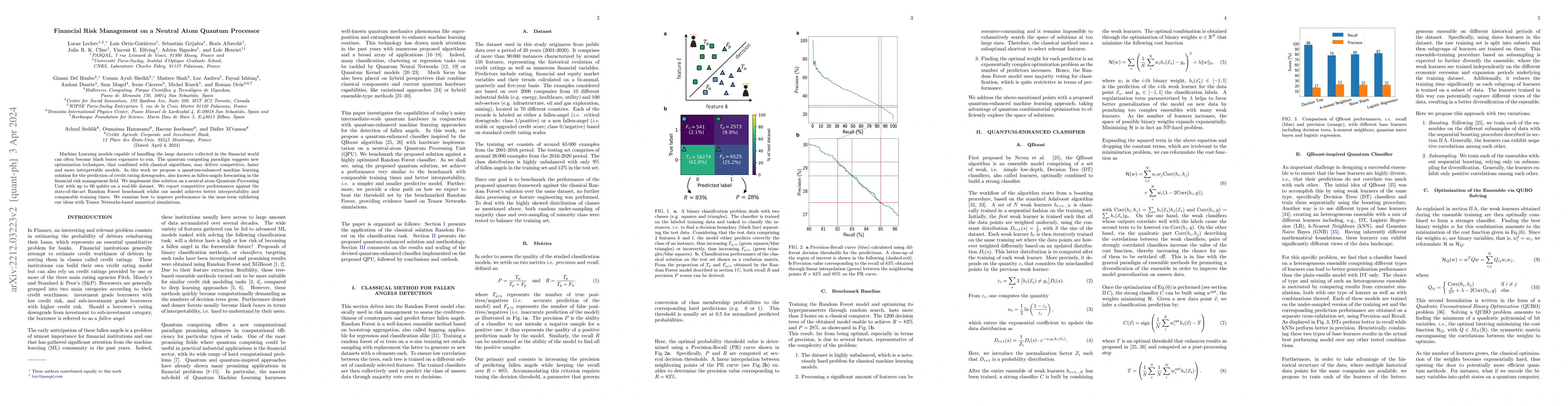

Financial Risk Management on a Neutral Atom Quantum Processor

Machine Learning models capable of handling the large datasets collected in the financial world can often become black boxes expensive to run. The quantum computing paradigm suggests new optimizatio...

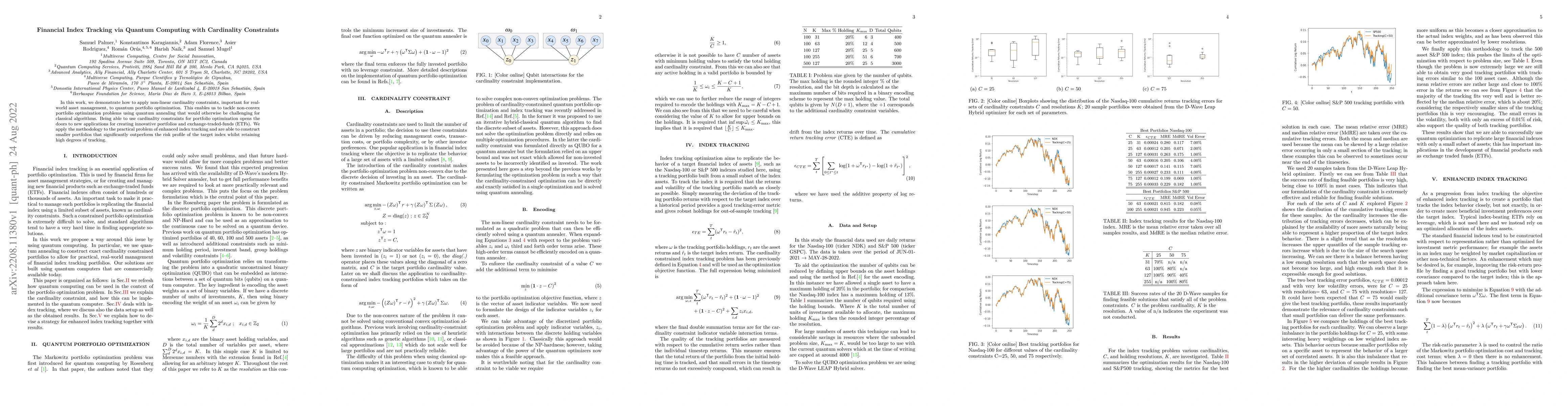

Financial Index Tracking via Quantum Computing with Cardinality Constraints

In this work, we demonstrate how to apply non-linear cardinality constraints, important for real-world asset management, to quantum portfolio optimization. This enables us to tackle non-convex portf...

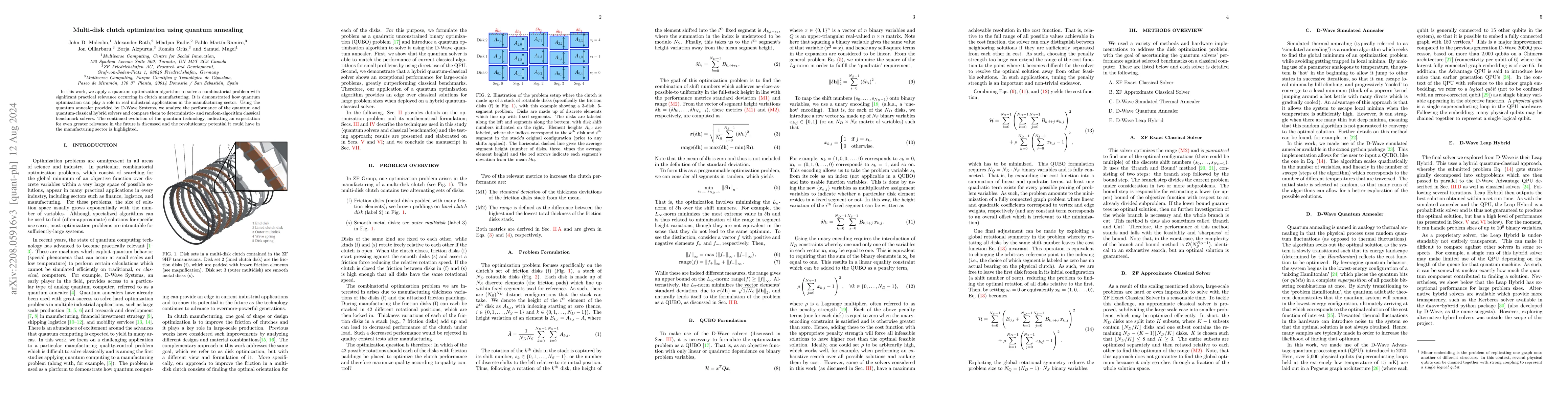

Multi-disk clutch optimization using quantum annealing

In this work, we develop a new quantum algorithm to solve a combinatorial problem with significant practical relevance occurring in clutch manufacturing. It is demonstrated how quantum optimization ...

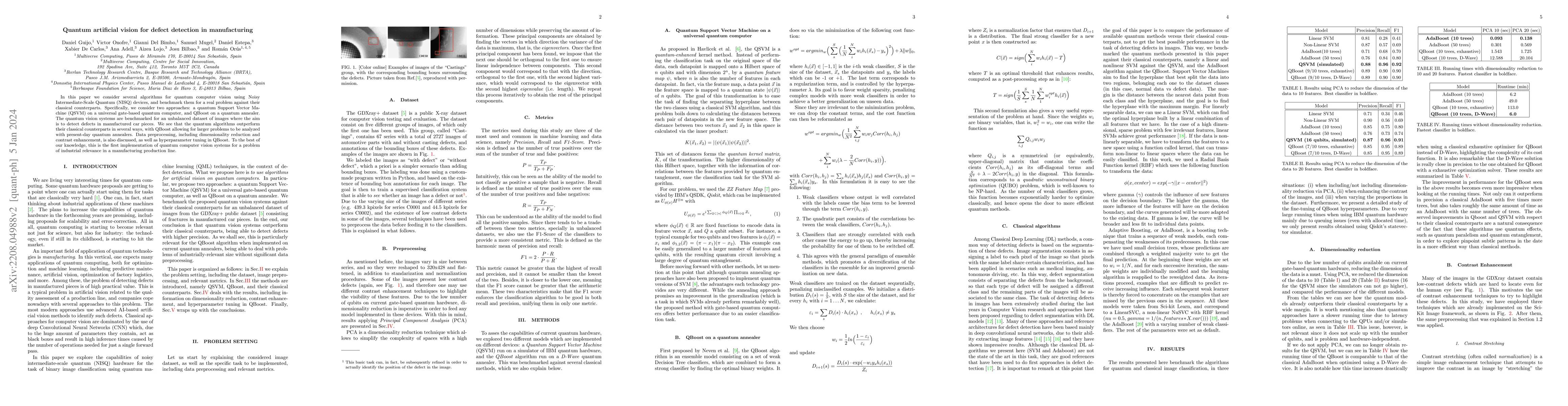

Quantum artificial vision for defect detection in manufacturing

In this paper we consider several algorithms for quantum computer vision using Noisy Intermediate-Scale Quantum (NISQ) devices, and benchmark them for a real problem against their classical counterp...

Quantum-Inspired Tensor Neural Networks for Partial Differential Equations

Partial Differential Equations (PDEs) are used to model a variety of dynamical systems in science and engineering. Recent advances in deep learning have enabled us to solve them in a higher dimensio...

Quantum portfolio value forecasting

We present an algorithm which efficiently estimates the intrinsic long-term value of a portfolio of assets on a quantum computer. The method relies on quantum amplitude estimation to estimate the me...

Hybrid Quantum Investment Optimization with Minimal Holding Period

In this paper we propose a hybrid quantum-classical algorithm for dynamic portfolio optimization with minimal holding period. Our algorithm is based on sampling the near-optimal portfolios at each t...

Dynamic Portfolio Optimization with Real Datasets Using Quantum Processors and Quantum-Inspired Tensor Networks

In this paper we tackle the problem of dynamic portfolio optimization, i.e., determining the optimal trading trajectory for an investment portfolio of assets over a period of time, taking into accou...

Towards Prediction of Financial Crashes with a D-Wave Quantum Computer

Prediction of financial crashes in a complex financial network is known to be an NP-hard problem, which means that no known algorithm can guarantee to find optimal solutions efficiently. We experime...

Encoding of Probability Distributions for Quantum Monte Carlo Using Tensor Networks

The application of Tensor Networks (TN) in quantum computing has shown promise, particularly for data loading. However, the assumption that data is readily available often renders the integration of T...

Quantim-Inspired Solver for Simulating Material Deformations

This paper explores the application of tensor networks (TNs) to the simulation of material deformations within the framework of linear elasticity. Material simulations are essential computational tool...

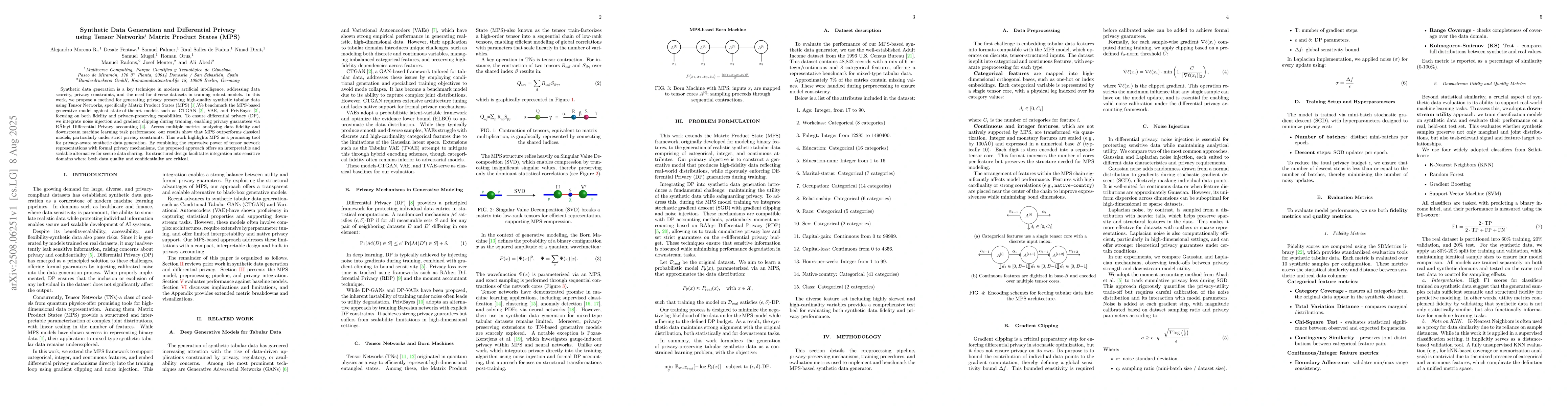

Synthetic Data Generation and Differential Privacy using Tensor Networks' Matrix Product States (MPS)

Synthetic data generation is a key technique in modern artificial intelligence, addressing data scarcity, privacy constraints, and the need for diverse datasets in training robust models. In this work...

Blockchain Network Analysis using Quantum Inspired Graph Neural Networks & Ensemble Models

In the rapidly evolving domain of financial technology, the detection of illicit transactions within blockchain networks remains a critical challenge, necessitating robust and innovative solutions. Th...