Summary

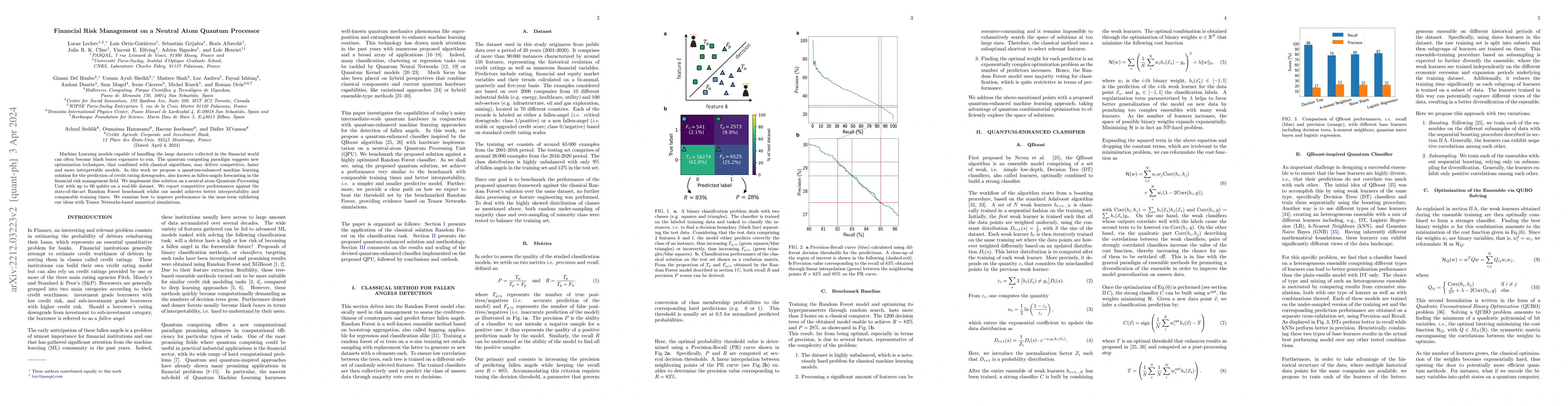

Machine Learning models capable of handling the large datasets collected in the financial world can often become black boxes expensive to run. The quantum computing paradigm suggests new optimization techniques, that combined with classical algorithms, may deliver competitive, faster and more interpretable models. In this work we propose a quantum-enhanced machine learning solution for the prediction of credit rating downgrades, also known as fallen-angels forecasting in the financial risk management field. We implement this solution on a neutral atom Quantum Processing Unit with up to 60 qubits on a real-life dataset. We report competitive performances against the state-of-the-art Random Forest benchmark whilst our model achieves better interpretability and comparable training times. We examine how to improve performance in the near-term validating our ideas with Tensor Networks-based numerical simulations.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLogical computation demonstrated with a neutral atom quantum processor

Xin Xie, Ming Li, Aarthi Sundaram et al.

Quantum Feature Maps for Graph Machine Learning on a Neutral Atom Quantum Processor

Louis-Paul Henry, Loïc Henriet, Lucas Leclerc et al.

Mixed Integer Linear Programming Solver Using Benders Decomposition Assisted by Neutral Atom Quantum Processor

M. Yassine Naghmouchi, Wesley da Silva Coelho

| Title | Authors | Year | Actions |

|---|

Comments (0)