Authors

Summary

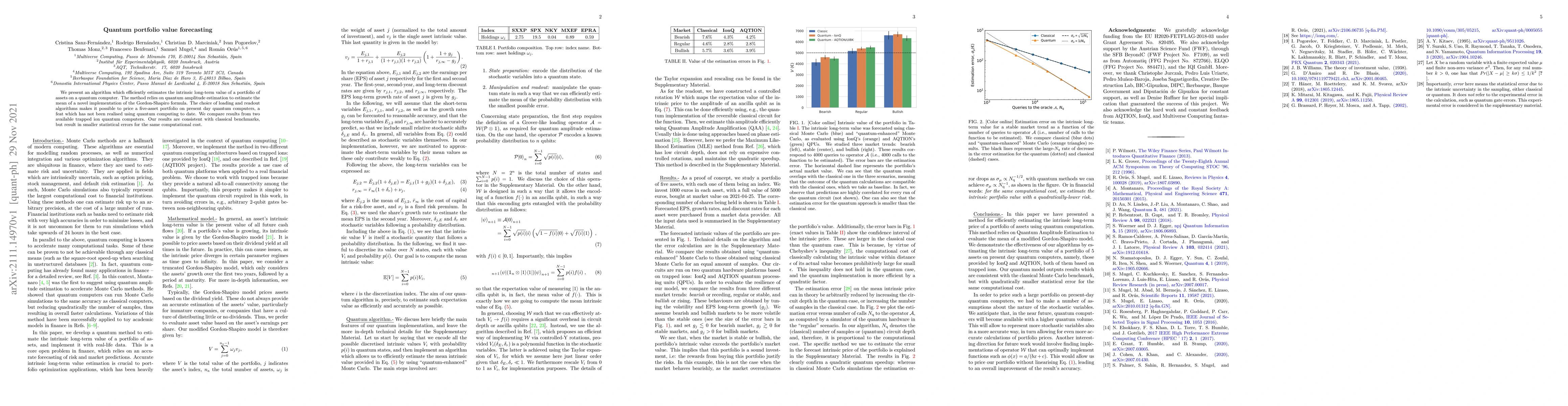

We present an algorithm which efficiently estimates the intrinsic long-term value of a portfolio of assets on a quantum computer. The method relies on quantum amplitude estimation to estimate the mean of a novel implementation of the Gordon-Shapiro formula. The choice of loading and readout algorithms makes it possible to price a five-asset portfolio on present day quantum computers, a feat which has not been realised using quantum computing to date. We compare results from two available trapped ion quantum computers. Our results are consistent with classical benchmarks, but result in smaller statistical errors for the same computational cost.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDependency Network-Based Portfolio Design with Forecasting and VaR Constraints

Zihan Lin, Haojie Liu, Randall R. Rojas

| Title | Authors | Year | Actions |

|---|

Comments (0)