Authors

Summary

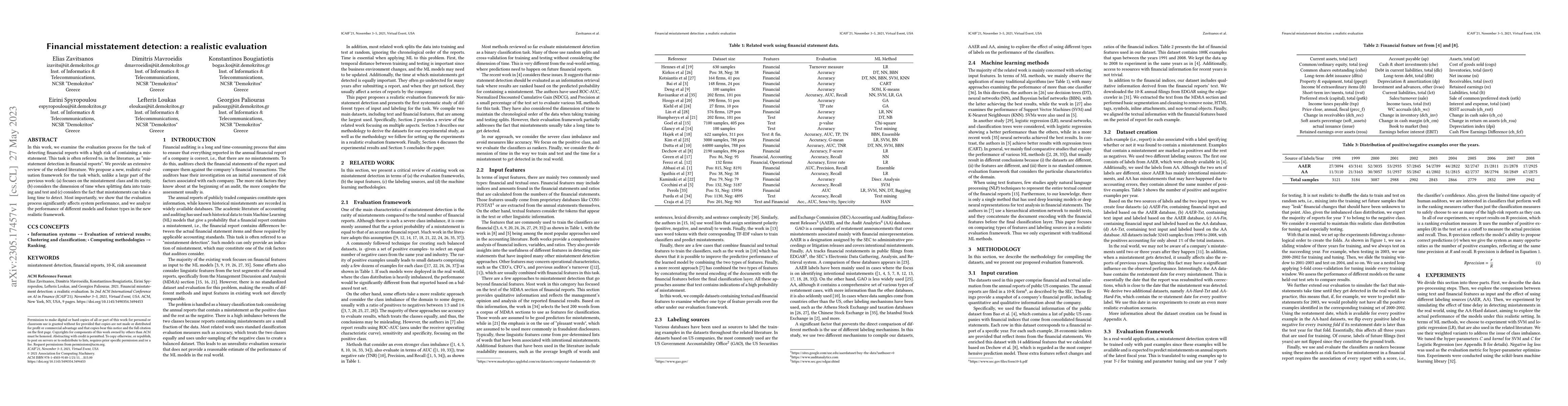

In this work, we examine the evaluation process for the task of detecting financial reports with a high risk of containing a misstatement. This task is often referred to, in the literature, as ``misstatement detection in financial reports''. We provide an extensive review of the related literature. We propose a new, realistic evaluation framework for the task which, unlike a large part of the previous work: (a) focuses on the misstatement class and its rarity, (b) considers the dimension of time when splitting data into training and test and (c) considers the fact that misstatements can take a long time to detect. Most importantly, we show that the evaluation process significantly affects system performance, and we analyze the performance of different models and feature types in the new realistic framework.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFinSearchComp: Towards a Realistic, Expert-Level Evaluation of Financial Search and Reasoning

Hongseok Namkoong, Xinyi Zhang, Xiang Gao et al.

Towards Realistic Out-of-Distribution Detection: A Novel Evaluation Framework for Improving Generalization in OOD Detection

Vahid Reza Khazaie, Mohammad Sabokrou, Anthony Wong

MAWIFlow Benchmark: Realistic Flow-Based Evaluation for Network Intrusion Detection

Alexander Windmann, Oliver Niggemann, Joshua Schraven

A (More) Realistic Evaluation Setup for Generalisation of Community Models on Malicious Content Detection

Ekaterina Shutova, Pushkar Mishra, Ivo Verhoeven et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)