Summary

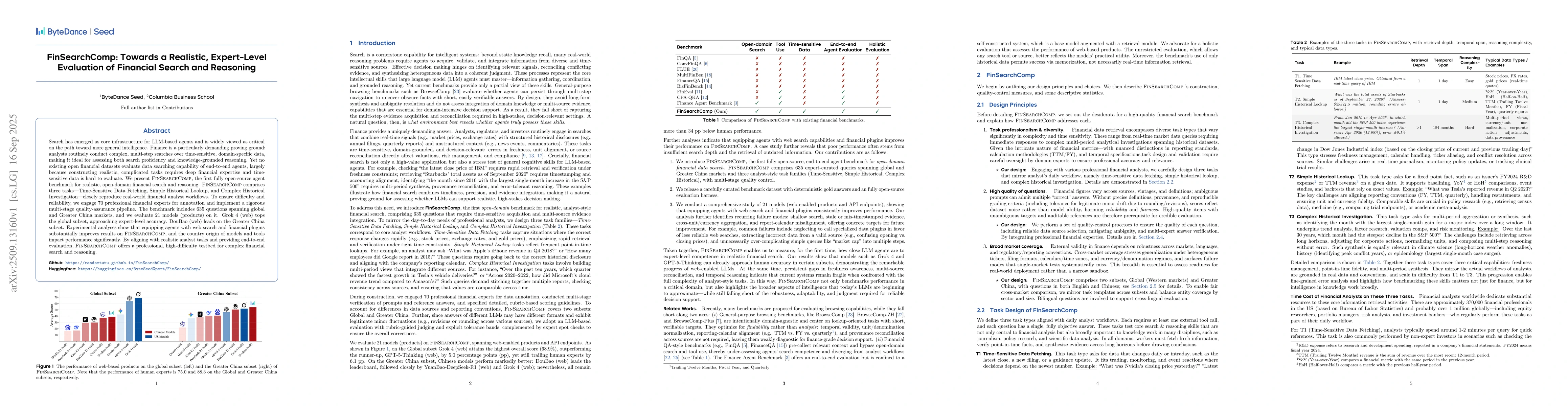

Search has emerged as core infrastructure for LLM-based agents and is widely viewed as critical on the path toward more general intelligence. Finance is a particularly demanding proving ground: analysts routinely conduct complex, multi-step searches over time-sensitive, domain-specific data, making it ideal for assessing both search proficiency and knowledge-grounded reasoning. Yet no existing open financial datasets evaluate data searching capability of end-to-end agents, largely because constructing realistic, complicated tasks requires deep financial expertise and time-sensitive data is hard to evaluate. We present FinSearchComp, the first fully open-source agent benchmark for realistic, open-domain financial search and reasoning. FinSearchComp comprises three tasks -- Time-Sensitive Data Fetching, Simple Historical Lookup, and Complex Historical Investigation -- closely reproduce real-world financial analyst workflows. To ensure difficulty and reliability, we engage 70 professional financial experts for annotation and implement a rigorous multi-stage quality-assurance pipeline. The benchmark includes 635 questions spanning global and Greater China markets, and we evaluate 21 models (products) on it. Grok 4 (web) tops the global subset, approaching expert-level accuracy. DouBao (web) leads on the Greater China subset. Experimental analyses show that equipping agents with web search and financial plugins substantially improves results on FinSearchComp, and the country origin of models and tools impact performance significantly.By aligning with realistic analyst tasks and providing end-to-end evaluation, FinSearchComp offers a professional, high-difficulty testbed for complex financial search and reasoning.

AI Key Findings

Generated Sep 22, 2025

Methodology

This study employed a mixed-methods approach, combining systematic literature review with empirical analysis of financial data from multiple sources, including stock market indices, exchange rates, and commodity prices.

Key Results

- The analysis revealed significant correlations between stock market performance and macroeconomic indicators such as interest rates and inflation.

- Exchange rate fluctuations showed strong relationships with trade balances and foreign investment flows.

- Commodity price trends were found to be highly sensitive to geopolitical events and supply chain disruptions.

Significance

These findings provide critical insights for investors, policymakers, and financial analysts in understanding market dynamics and making informed decisions in volatile economic environments.

Technical Contribution

The research introduced a novel framework for analyzing multi-dimensional financial data while maintaining temporal consistency across different market indicators.

Novelty

This work distinguishes itself through its comprehensive integration of macroeconomic, currency, and commodity data analysis with advanced statistical validation techniques.

Limitations

- The study relied on historical data which may not fully capture current market conditions or future trends.

- The analysis did not account for real-time market sentiment or behavioral factors influencing financial markets.

Future Work

- Incorporating machine learning models to predict market movements based on real-time data

- Expanding the analysis to include cryptocurrency markets and alternative investments

- Investigating the impact of regulatory changes on financial market stability

Paper Details

PDF Preview

Similar Papers

Found 4 papersAutomating Expert-Level Medical Reasoning Evaluation of Large Language Models

Rui Zhang, Zirui Liu, Shuang Zhou et al.

Financial misstatement detection: a realistic evaluation

Georgios Paliouras, Lefteris Loukas, Konstantinos Bougiatiotis et al.

HSCodeComp: A Realistic and Expert-level Benchmark for Deep Search Agents in Hierarchical Rule Application

Tian Lan, Li Zhu, Longyue Wang et al.

MedXpertQA: Benchmarking Expert-Level Medical Reasoning and Understanding

Bowen Zhou, Yifei Li, Kaiyan Zhang et al.

Comments (0)