Authors

Summary

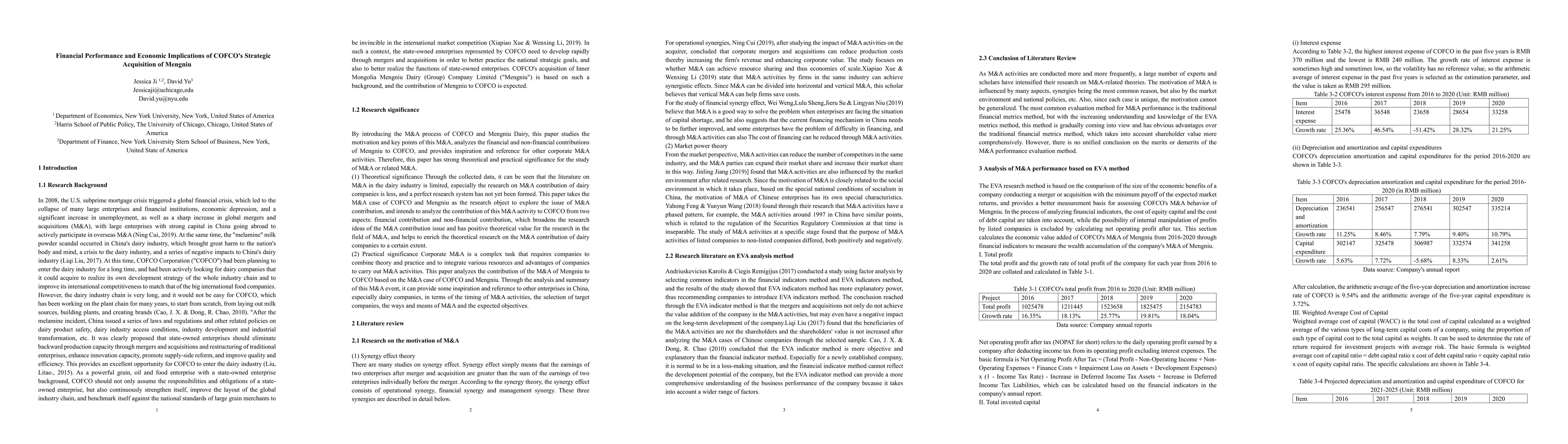

This paper examines the merger and acquisition (M&A) process between COFCO and Mengniu Dairy, exploring the motivations behind this strategic move and identifying its key aspects. By analyzing both the financial and non-financial contributions of Mengniu Dairy to COFCO, this study provides valuable insights and references for future corporate M&A activities. The theoretical significance of this research lies in its focus on the relatively underexplored area of M&A within the dairy industry, particularly in terms of M&A contributions. Using the COFCO-Mengniu case as a model, the study broadens current research perspectives by assessing the impact of M&A from financial and non-financial standpoints, enriching the body of literature on dairy industry M&As.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersTransforming Investment Strategies and Strategic Decision-Making: Unveiling a Novel Methodology for Enhanced Performance and Risk Management in Financial Markets

Tian Tian, Qingquan Zhang, Ricky Cooper et al.

No citations found for this paper.

Comments (0)