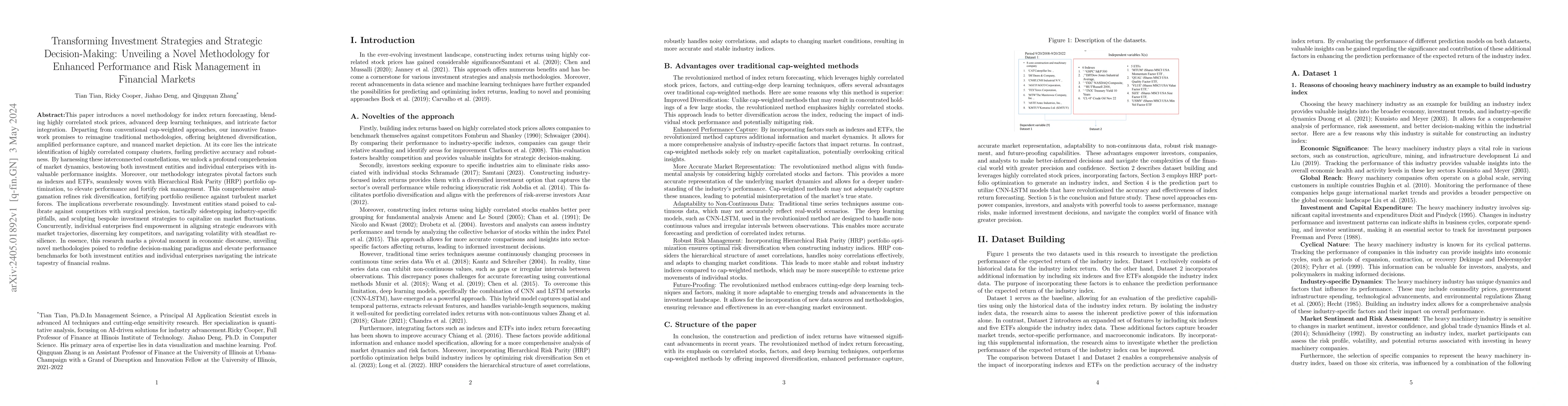

Summary

This paper introduces a novel methodology for index return forecasting, blending highly correlated stock prices, advanced deep learning techniques, and intricate factor integration. Departing from conventional cap-weighted approaches, our innovative framework promises to reimagine traditional methodologies, offering heightened diversification, amplified performance capture, and nuanced market depiction. At its core lies the intricate identification of highly correlated company clusters, fueling predictive accuracy and robustness. By harnessing these interconnected constellations, we unlock a profound comprehension of market dynamics, bestowing both investment entities and individual enterprises with invaluable performance insights. Moreover, our methodology integrates pivotal factors such as indexes and ETFs, seamlessly woven with Hierarchical Risk Parity (HRP) portfolio optimization, to elevate performance and fortify risk management. This comprehensive amalgamation refines risk diversification, fortifying portfolio resilience against turbulent market forces. The implications reverberate resoundingly. Investment entities stand poised to calibrate against competitors with surgical precision, tactically sidestepping industry-specific pitfalls, and sculpting bespoke investment strategies to capitalize on market fluctuations. Concurrently, individual enterprises find empowerment in aligning strategic endeavors with market trajectories, discerning key competitors, and navigating volatility with steadfast resilience. In essence, this research marks a pivotal moment in economic discourse, unveiling novel methodologies poised to redefine decision-making paradigms and elevate performance benchmarks for both investment entities and individual enterprises navigating the intricate tapestry of financial realms.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersVisualizing Machine Learning Models for Enhanced Financial Decision-Making and Risk Management

Priyam Ganguly, Isha Mukherjee, Ramakrishna Garine

Enhancing Financial Data Visualization for Investment Decision-Making

Nisarg Patel, Harmit Shah, Kishan Mewada

FinCon: A Synthesized LLM Multi-Agent System with Conceptual Verbal Reinforcement for Enhanced Financial Decision Making

Jimin Huang, Qianqian Xie, Dong Li et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)