Summary

This study emphasizes how crucial it is to visualize machine learning models, especially for the banking industry, in order to improve interpretability and support predictions in high stakes financial settings. Visual tools enable performance improvements and support the creation of innovative financial models by offering crucial insights into the algorithmic decision-making processes. Within a financial machine learning framework, the research uses visually guided experiments to make important concepts, such risk assessment and portfolio allocation, more understandable. The study also examines variations in trading tactics and how they relate to risk appetite, coming to the conclusion that the frequency of portfolio rebalancing is negatively correlated with risk tolerance. Finding these ideas is made possible in large part by visualization. The study concludes by presenting a novel method of locally stochastic asset weighing, where visualization facilitates data extraction and validation. This highlights the usefulness of these methods in furthering the field of financial machine learning research.

AI Key Findings

Generated Jun 11, 2025

Methodology

The Tsetlin Machine (TM) is designed to process Boolean input vectors, utilizing TAs to dynamically allocate literals and negated literals to states that maximize rewards. Literals deemed relevant are combined using a conjunction operator, forming clauses that contribute to class predictions through voting. The TM's fixed finite-state approach ensures computational efficiency.

Key Results

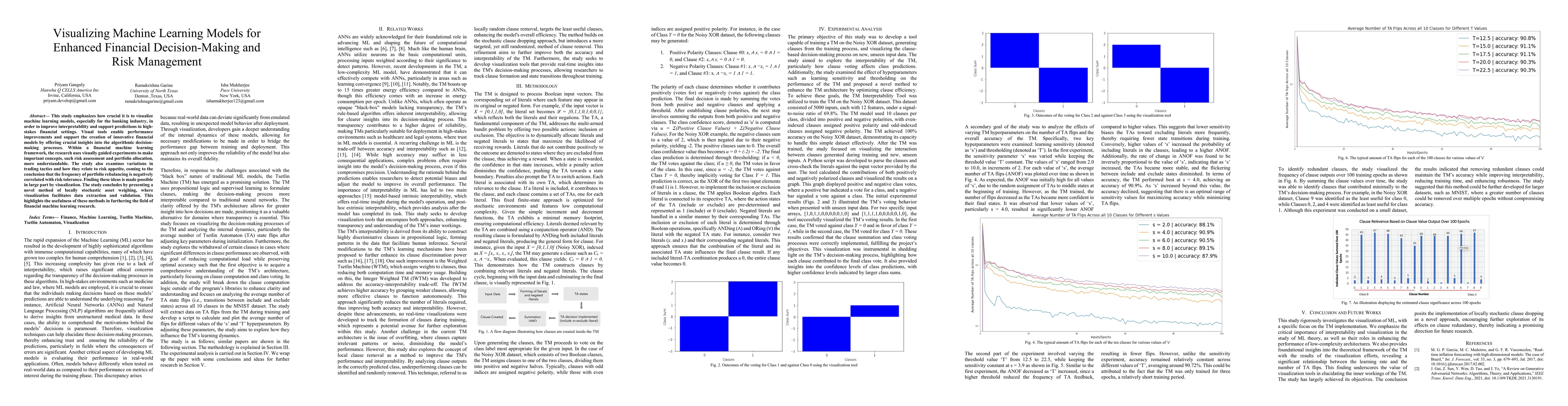

- The study developed visualization tools to track clause formation and state transitions during TM training.

- The TM achieved 100% accuracy on the Noisy XOR dataset, demonstrating its capacity to handle simple datasets effectively.

- Lower sensitivity values in TM resulted in fewer TA flips, indicating lower bias towards including literals.

- Higher threshold values reduced TA flips but had minimal impact on accuracy, suggesting a stable TM performance across thresholds.

- Visualization of clause outputs revealed redundant clauses, indicating potential for improving interpretability and efficiency by removing them.

Significance

This research emphasizes the importance of interpretability and visualization in machine learning, particularly for low-complexity architectures like the Tsetlin Machine, enhancing performance and trust in high-stakes financial settings.

Technical Contribution

The study presents a novel method of locally stochastic asset weighing, facilitated by visualization, to further financial machine learning research.

Novelty

This work differentiates itself by focusing on the interpretability of TMs through visualization, proposing a novel method for clause optimization, and demonstrating its application in financial decision-making and risk management.

Limitations

- The study was conducted on a small Noisy XOR dataset, limiting the generalizability of findings to larger, more complex datasets.

- The visualization tool's effectiveness in handling diverse and larger datasets remains to be explored.

Future Work

- Explore the application of visualization tools on larger datasets, such as MNIST, to validate their effectiveness in diverse contexts.

- Investigate the impact of locally stochastic clause dropping on larger datasets and its potential for improving model robustness and efficiency.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTransforming Investment Strategies and Strategic Decision-Making: Unveiling a Novel Methodology for Enhanced Performance and Risk Management in Financial Markets

Tian Tian, Qingquan Zhang, Ricky Cooper et al.

Interpretable Machine Learning for Self-Service High-Risk Decision-Making

Boris Kovalerchuk, Charles Recaido

Generative AI Enhanced Financial Risk Management Information Retrieval

Amin Haeri, Jonathan Vitrano, Mahdi Ghelichi

FinHEAR: Human Expertise and Adaptive Risk-Aware Temporal Reasoning for Financial Decision-Making

Zhuo Wang, Chi Zhang, Jiaxiang Chen et al.

No citations found for this paper.

Comments (0)