Summary

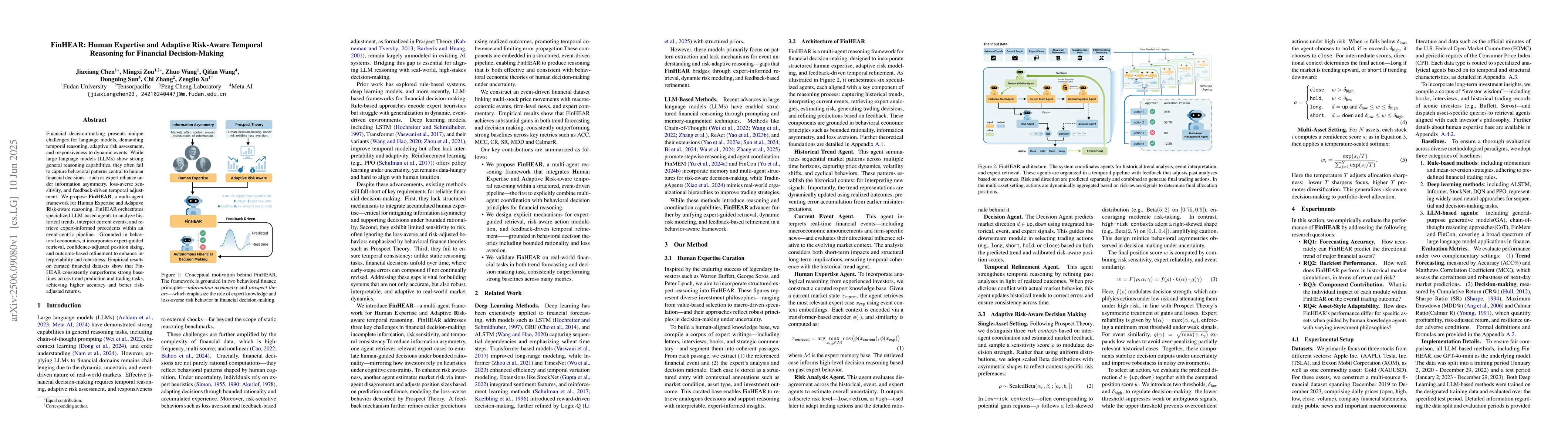

Financial decision-making presents unique challenges for language models, demanding temporal reasoning, adaptive risk assessment, and responsiveness to dynamic events. While large language models (LLMs) show strong general reasoning capabilities, they often fail to capture behavioral patterns central to human financial decisions-such as expert reliance under information asymmetry, loss-averse sensitivity, and feedback-driven temporal adjustment. We propose FinHEAR, a multi-agent framework for Human Expertise and Adaptive Risk-aware reasoning. FinHEAR orchestrates specialized LLM-based agents to analyze historical trends, interpret current events, and retrieve expert-informed precedents within an event-centric pipeline. Grounded in behavioral economics, it incorporates expert-guided retrieval, confidence-adjusted position sizing, and outcome-based refinement to enhance interpretability and robustness. Empirical results on curated financial datasets show that FinHEAR consistently outperforms strong baselines across trend prediction and trading tasks, achieving higher accuracy and better risk-adjusted returns.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersExploring Cognitive Attributes in Financial Decision-Making

Rosina O. Weber, Mallika Mainali

Visualizing Machine Learning Models for Enhanced Financial Decision-Making and Risk Management

Priyam Ganguly, Isha Mukherjee, Ramakrishna Garine

Specification Architectural Viewpoint for Benefit-Cost-Risk-Aware Decision-Making in Self-Adaptive Systems

Radu Calinescu, Danny Weyns, Paris Avegriou et al.

No citations found for this paper.

Comments (0)