Authors

Summary

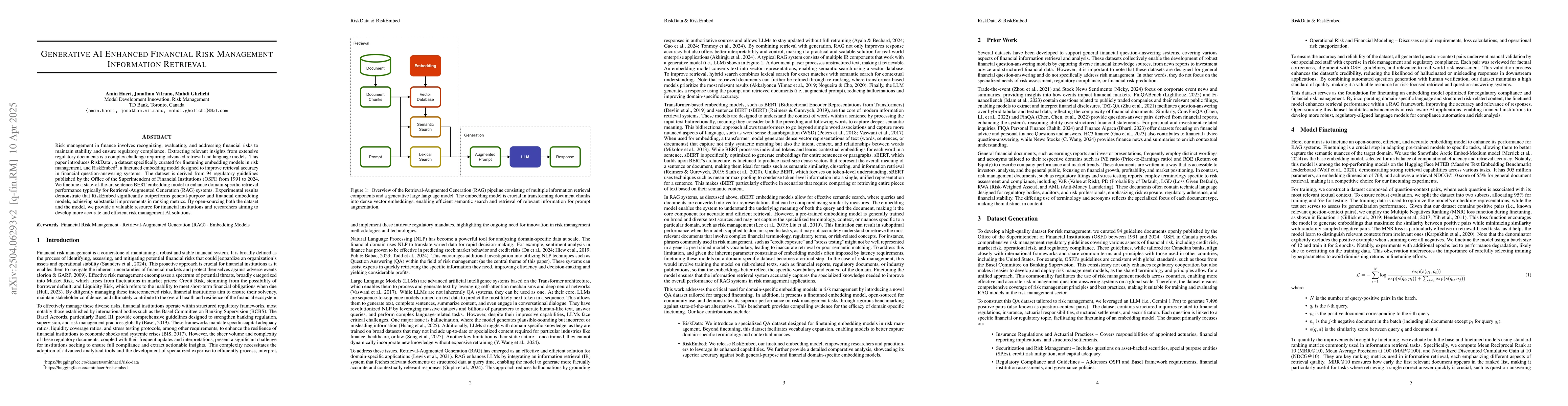

Risk management in finance involves recognizing, evaluating, and addressing financial risks to maintain stability and ensure regulatory compliance. Extracting relevant insights from extensive regulatory documents is a complex challenge requiring advanced retrieval and language models. This paper introduces RiskData, a dataset specifically curated for finetuning embedding models in risk management, and RiskEmbed, a finetuned embedding model designed to improve retrieval accuracy in financial question-answering systems. The dataset is derived from 94 regulatory guidelines published by the Office of the Superintendent of Financial Institutions (OSFI) from 1991 to 2024. We finetune a state-of-the-art sentence BERT embedding model to enhance domain-specific retrieval performance typically for Retrieval-Augmented Generation (RAG) systems. Experimental results demonstrate that RiskEmbed significantly outperforms general-purpose and financial embedding models, achieving substantial improvements in ranking metrics. By open-sourcing both the dataset and the model, we provide a valuable resource for financial institutions and researchers aiming to develop more accurate and efficient risk management AI solutions.

AI Key Findings

Generated Jun 10, 2025

Methodology

The paper introduces RiskData, a curated dataset for finetuning embedding models in risk management, derived from 94 OSFI regulatory guidelines (1991-2024). It finetunes a sentence BERT embedding model (RiskEmbed) to enhance domain-specific retrieval for financial question-answering systems.

Key Results

- RiskEmbed significantly outperforms general-purpose and financial embedding models in ranking metrics for financial question-answering systems.

- Experimental results demonstrate substantial improvements in retrieval accuracy with RiskEmbed.

Significance

This research provides a valuable resource (RiskData and RiskEmbed) for financial institutions and researchers to develop more accurate and efficient risk management AI solutions, ensuring regulatory compliance and maintaining financial stability.

Technical Contribution

RiskData and RiskEmbed, a finetuned embedding model specifically designed for financial risk management information retrieval.

Novelty

The paper's novelty lies in its focus on finetuning language models for financial risk management using a specialized dataset, RiskData, and demonstrating significant improvements over existing models with RiskEmbed.

Limitations

- The dataset is limited to OSFI guidelines, potentially missing other crucial financial regulatory information from other jurisdictions.

- Performance may vary with newer, less standardized regulatory text formats.

Future Work

- Explore integration with more advanced generative AI techniques for enhanced risk assessment.

- Expand the dataset to include guidelines from other regulatory bodies for broader applicability.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersModel Risk Management for Generative AI In Financial Institutions

Anwesha Bhattacharyya, Rahul Singh, Tarun Joshi et al.

Toward Agentic AI: Generative Information Retrieval Inspired Intelligent Communications and Networking

Dusit Niyato, Shiwen Mao, Zhu Han et al.

Information Retrieval in the Age of Generative AI: The RGB Model

Alberto Tarable, Franco Galante, Emilio Leonardi et al.

Future of Information Retrieval Research in the Age of Generative AI

James Allan, Hamed Zamani, Eunsol Choi et al.

No citations found for this paper.

Comments (0)