Summary

The success of OpenAI's ChatGPT in 2023 has spurred financial enterprises into exploring Generative AI applications to reduce costs or drive revenue within different lines of businesses in the Financial Industry. While these applications offer strong potential for efficiencies, they introduce new model risks, primarily hallucinations and toxicity. As highly regulated entities, financial enterprises (primarily large US banks) are obligated to enhance their model risk framework with additional testing and controls to ensure safe deployment of such applications. This paper outlines the key aspects for model risk management of generative AI model with a special emphasis on additional practices required in model validation.

AI Key Findings

Generated Jun 10, 2025

Methodology

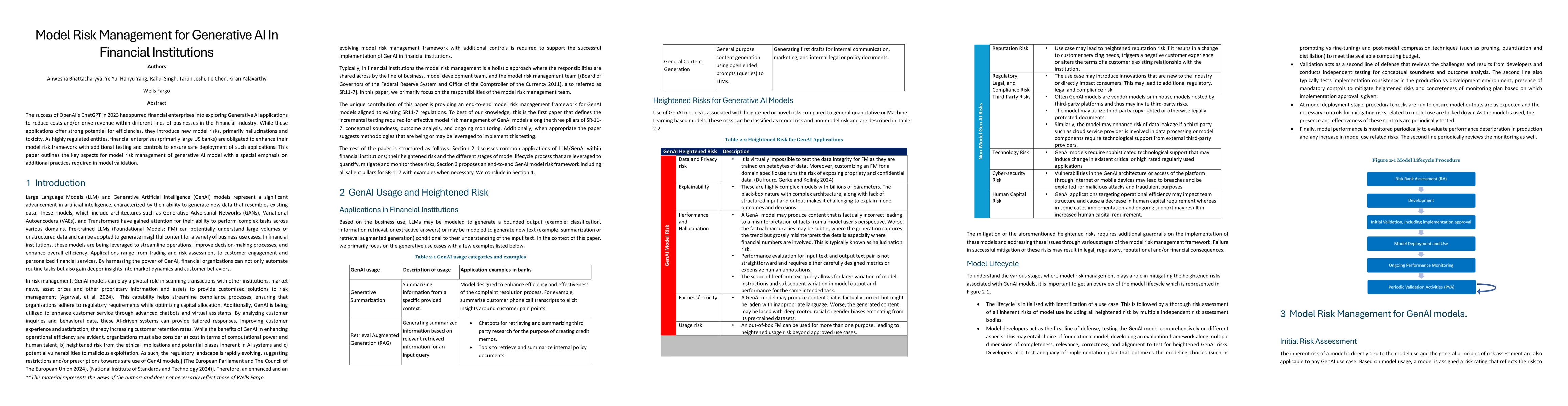

The paper outlines a model risk management framework for Generative AI in financial institutions, with a focus on additional testing and controls required during model validation to address hallucinations and toxicity risks.

Key Results

- Financial institutions must enhance their model risk framework to ensure safe deployment of Generative AI applications.

- Model risk management should consider reliance on model output, material impact on business, complexity of modeling choices, and feasibility of required controls.

Significance

This research is crucial for highly regulated financial enterprises to navigate the new model risks introduced by Generative AI, ensuring compliance and safe usage in various business lines.

Technical Contribution

The paper proposes a detailed testing framework for Generative AI models, focusing on conceptual soundness and outcome analysis, with specific attention to LLM/GenAI-specific challenges.

Novelty

This work offers a tailored model risk management approach for Generative AI in financial institutions, addressing unique challenges such as hallucinations and toxicity, which are not typically covered in traditional model risk management practices.

Limitations

- The paper does not provide specific quantitative metrics for assessing model risk management effectiveness.

- Limited scope to large US banks, with less focus on other types of financial institutions.

Future Work

- Further research on developing quantitative metrics for model risk management effectiveness.

- Exploration of model risk management practices in various types of financial institutions beyond large US banks.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersGenerative AI Enhanced Financial Risk Management Information Retrieval

Amin Haeri, Jonathan Vitrano, Mahdi Ghelichi

Lessons From Model Risk Management in Financial Institutions for Academic Research

Mahmood Alaghmandan, Olga Streltchenko

No citations found for this paper.

Comments (0)