Authors

Summary

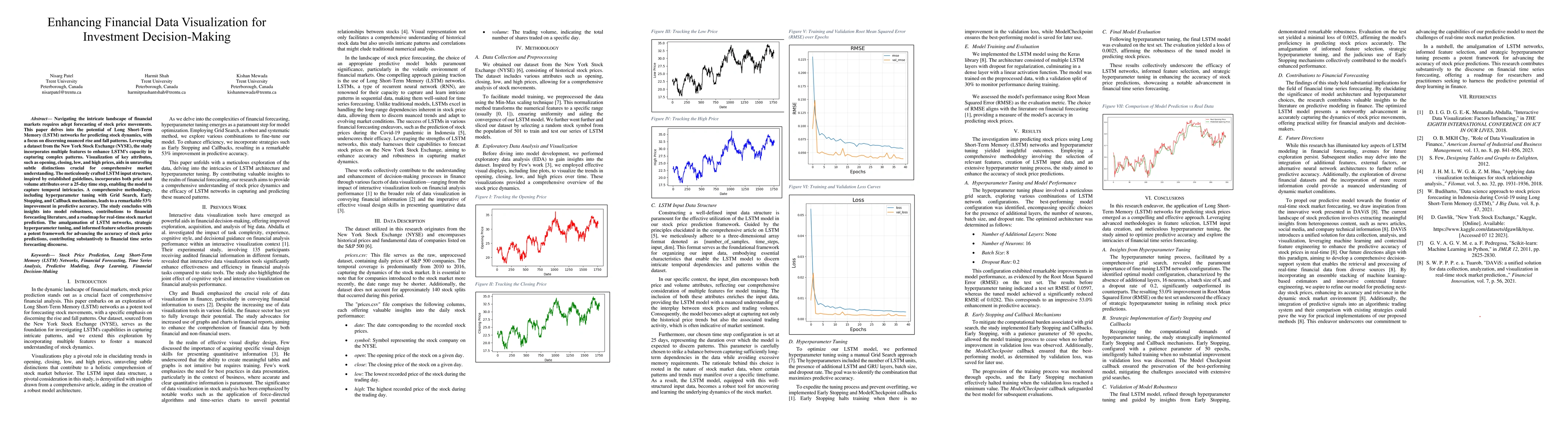

Navigating the intricate landscape of financial markets requires adept forecasting of stock price movements. This paper delves into the potential of Long Short-Term Memory (LSTM) networks for predicting stock dynamics, with a focus on discerning nuanced rise and fall patterns. Leveraging a dataset from the New York Stock Exchange (NYSE), the study incorporates multiple features to enhance LSTM's capacity in capturing complex patterns. Visualization of key attributes, such as opening, closing, low, and high prices, aids in unraveling subtle distinctions crucial for comprehensive market understanding. The meticulously crafted LSTM input structure, inspired by established guidelines, incorporates both price and volume attributes over a 25-day time step, enabling the model to capture temporal intricacies. A comprehensive methodology, including hyperparameter tuning with Grid Search, Early Stopping, and Callback mechanisms, leads to a remarkable 53% improvement in predictive accuracy. The study concludes with insights into model robustness, contributions to financial forecasting literature, and a roadmap for real-time stock market prediction. The amalgamation of LSTM networks, strategic hyperparameter tuning, and informed feature selection presents a potent framework for advancing the accuracy of stock price predictions, contributing substantively to financial time series forecasting discourse.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEnhancing Investment Analysis: Optimizing AI-Agent Collaboration in Financial Research

Neng Wang, Kunpeng Zhang, Sean Xin Xu et al.

Aiding Humans in Financial Fraud Decision Making: Toward an XAI-Visualization Framework

Angelos Chatzimparmpas, Evanthia Dimara

A Typology of Decision-Making Tasks for Visualization

Remco Chang, Gabriel Appleby, Camelia D. Brumar et al.

Data Visualization for Improving Financial Literacy: A Systematic Review

Robert Amor, Kwan-Liu Ma, Meng Du et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)