Summary

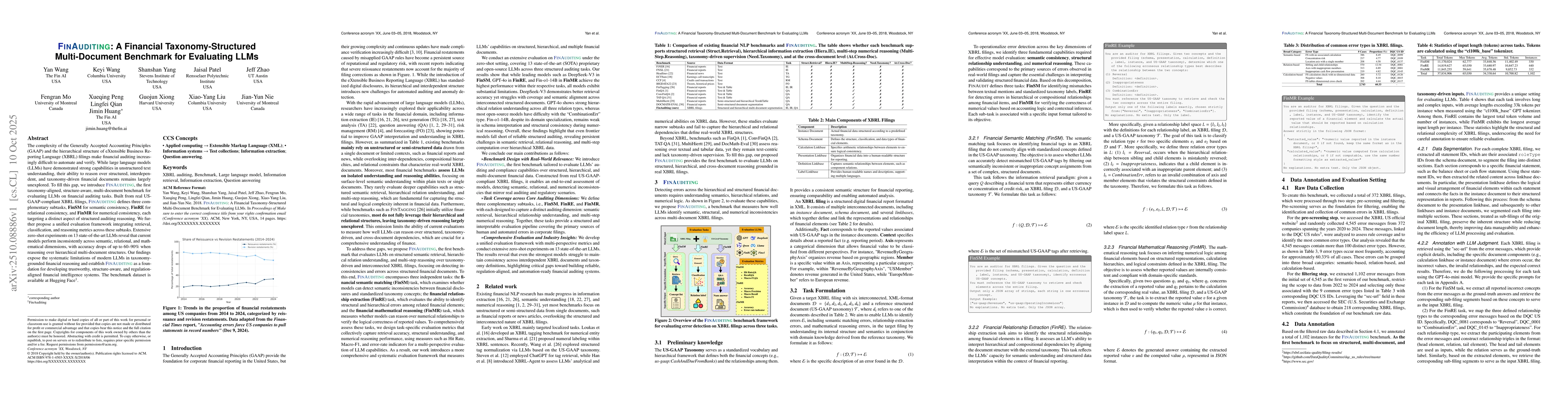

The complexity of the Generally Accepted Accounting Principles (GAAP) and the hierarchical structure of eXtensible Business Reporting Language (XBRL) filings make financial auditing increasingly difficult to automate and verify. While large language models (LLMs) have demonstrated strong capabilities in unstructured text understanding, their ability to reason over structured, interdependent, and taxonomy-driven financial documents remains largely unexplored. To fill this gap, we introduce FinAuditing, the first taxonomy-aligned, structure-aware, multi-document benchmark for evaluating LLMs on financial auditing tasks. Built from real US-GAAP-compliant XBRL filings, FinAuditing defines three complementary subtasks, FinSM for semantic consistency, FinRE for relational consistency, and FinMR for numerical consistency, each targeting a distinct aspect of structured auditing reasoning. We further propose a unified evaluation framework integrating retrieval, classification, and reasoning metrics across these subtasks. Extensive zero-shot experiments on 13 state-of-the-art LLMs reveal that current models perform inconsistently across semantic, relational, and mathematical dimensions, with accuracy drops of up to 60-90% when reasoning over hierarchical multi-document structures. Our findings expose the systematic limitations of modern LLMs in taxonomy-grounded financial reasoning and establish FinAuditing as a foundation for developing trustworthy, structure-aware, and regulation-aligned financial intelligence systems. The benchmark dataset is available at Hugging Face.

AI Key Findings

Generated Oct 16, 2025

Methodology

The research employed a multi-task learning framework to evaluate large language models (LLMs) on three financial tasks: statement name extraction, erroneous tag identification, and relationship error detection. The models were trained on XBRL filings with DQC validation messages, using structured JSON outputs for annotation.

Key Results

- Large models like Qwen3 and Gemma outperformed smaller models in all tasks, achieving over 90% accuracy in statement name extraction

- Erroneous tag identification showed significant variation between model sizes, with the largest models achieving 85% precision

- Relationship error detection had the highest variance, with top models reaching 78% F1 score while smaller models struggled below 60%

Significance

This research provides critical insights into the capabilities and limitations of LLMs in financial data validation tasks, which is essential for improving audit accuracy and regulatory compliance in financial reporting.

Technical Contribution

The work introduces a standardized multi-task annotation framework for financial validation tasks, along with benchmark results for various LLM architectures on structured financial data tasks.

Novelty

This is the first comprehensive evaluation of LLMs across three distinct financial validation tasks using structured XBRL data with DQC validation messages, providing a benchmark for future research in financial natural language processing.

Limitations

- The study focused on US GAAP filings which may limit generalizability to other accounting standards

- The evaluation primarily used synthetic validation messages rather than real-world audit scenarios

- Model performance metrics were based on structured outputs rather than natural language explanations

Future Work

- Investigate model performance across different accounting standards (IFRS, IFRS for SMEs, etc.)

- Develop hybrid models combining LLMs with rule-based systems for enhanced validation

- Create benchmark datasets with real-world audit scenarios for more practical evaluation

- Explore model interpretability to understand error sources in financial validation

Paper Details

PDF Preview

Similar Papers

Found 5 papersEvaluating LLMs' Mathematical Reasoning in Financial Document Question Answering

Vivek Gupta, Dan Roth, Tanuja Ganu et al.

M3SciQA: A Multi-Modal Multi-Document Scientific QA Benchmark for Evaluating Foundation Models

Yixin Liu, Arman Cohan, Yilun Zhao et al.

SEAM: A Stochastic Benchmark for Multi-Document Tasks

Avi Caciularu, Gili Lior, Arie Cattan et al.

DOCBENCH: A Benchmark for Evaluating LLM-based Document Reading Systems

Zhuosheng Zhang, Hai Zhao, Wenhao Yu et al.

BizFinBench: A Business-Driven Real-World Financial Benchmark for Evaluating LLMs

Ji Liu, Rongjunchen Zhang, Wenqiao Zhu et al.

Comments (0)