Summary

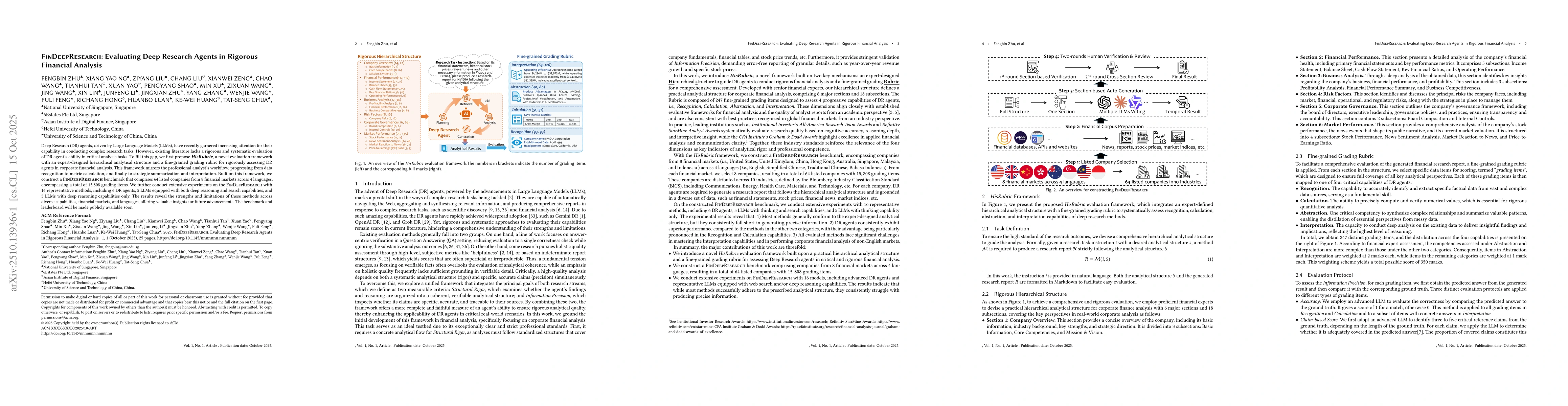

Deep Research (DR) agents, powered by advanced Large Language Models (LLMs), have recently garnered increasing attention for their capability in conducting complex research tasks. However, existing literature lacks a rigorous and systematic evaluation of DR Agent's capabilities in critical research analysis. To address this gap, we first propose HisRubric, a novel evaluation framework with a hierarchical analytical structure and a fine-grained grading rubric for rigorously assessing DR agents' capabilities in corporate financial analysis. This framework mirrors the professional analyst's workflow, progressing from data recognition to metric calculation, and finally to strategic summarization and interpretation. Built on this framework, we construct a FinDeepResearch benchmark that comprises 64 listed companies from 8 financial markets across 4 languages, encompassing a total of 15,808 grading items. We further conduct extensive experiments on the FinDeepResearch using 16 representative methods, including 6 DR agents, 5 LLMs equipped with both deep reasoning and search capabilities, and 5 LLMs with deep reasoning capabilities only. The results reveal the strengths and limitations of these approaches across diverse capabilities, financial markets, and languages, offering valuable insights for future research and development. The benchmark and evaluation code will be made publicly available.

AI Key Findings

Generated Oct 30, 2025

Methodology

The study compares the performance of various large language models (LLMs) across multiple financial analysis tasks using a structured markdown-based research specification. It evaluates models like Gemini, Claude, DeepSeek, Grok, and GPT-5 through a hierarchical framework that includes financial statements, business analysis, risk factors, and market performance.

Key Results

- DeepResearch models outperform traditional LLMs in structured financial analysis tasks

- Models with search capabilities show better performance in dynamic financial data analysis

- The hierarchical framework improves reproducibility and comparability across different models

Significance

This research provides a standardized benchmark for evaluating financial analysis capabilities of LLMs, which is critical for applications in financial services, investment analysis, and corporate research.

Technical Contribution

Development of a hierarchical markdown-based research specification for structured financial analysis

Novelty

Integration of search capabilities with financial analysis frameworks and the creation of a standardized benchmark for evaluating LLMs in financial contexts

Limitations

- The study relies on a limited set of financial metrics

- The benchmark may not capture all aspects of financial analysis

Future Work

- Expanding the benchmark to include more financial indicators

- Incorporating real-time market data analysis

Paper Details

PDF Preview

Similar Papers

Found 5 papersFinSight: Towards Real-World Financial Deep Research

Yutao Zhu, Zhicheng Dou, Yuyao Zhang et al.

Deep Research Comparator: A Platform For Fine-grained Human Annotations of Deep Research Agents

Chenyan Xiong, Leonardo F. R. Ribeiro, Akari Asai et al.

A Rigorous Benchmark with Multidimensional Evaluation for Deep Research Agents: From Answers to Reports

Keming Wu, Yingchun Wang, Yuxuan Zhang et al.

Comments (0)