Summary

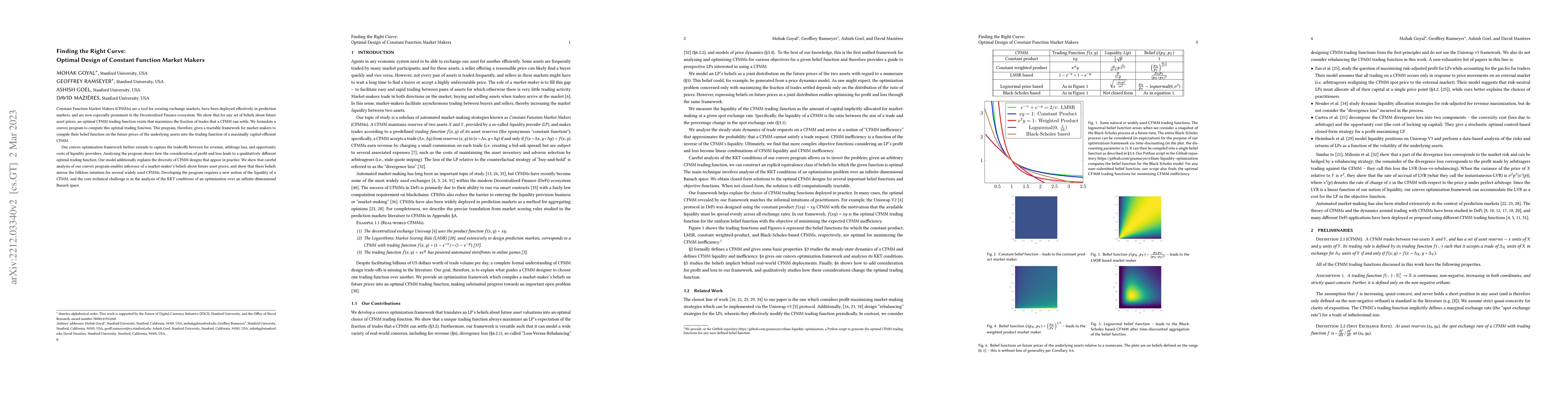

Constant Function Market Makers (CFMMs) are a tool for creating exchange markets, have been deployed effectively in prediction markets, and are now especially prominent in the Decentralized Finance ecosystem. We show that for any set of beliefs about future asset prices, an optimal CFMM trading function exists that maximizes the fraction of trades that a CFMM can settle. We formulate a convex program to compute this optimal trading function. This program, therefore, gives a tractable framework for market-makers to compile their belief function on the future prices of the underlying assets into the trading function of a maximally capital-efficient CFMM. Our convex optimization framework further extends to capture the tradeoffs between fee revenue, arbitrage loss, and opportunity costs of liquidity providers. Analyzing the program shows how the consideration of profit and loss leads to a qualitatively different optimal trading function. Our model additionally explains the diversity of CFMM designs that appear in practice. We show that careful analysis of our convex program enables inference of a market-maker's beliefs about future asset prices, and show that these beliefs mirror the folklore intuition for several widely used CFMMs. Developing the program requires a new notion of the liquidity of a CFMM, and the core technical challenge is in the analysis of the KKT conditions of an optimization over an infinite-dimensional Banach space.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOptimal Routing for Constant Function Market Makers

Alex Evans, Stephen Boyd, Guillermo Angeris et al.

A Note on Optimal Fees for Constant Function Market Makers

Roger Wattenhofer, Robin Fritsch

Axioms for Constant Function Market Makers

Mateusz Kwaśnicki, Akaki Mamageishvili, Jan Christoph Schlegel

| Title | Authors | Year | Actions |

|---|

Comments (0)