Summary

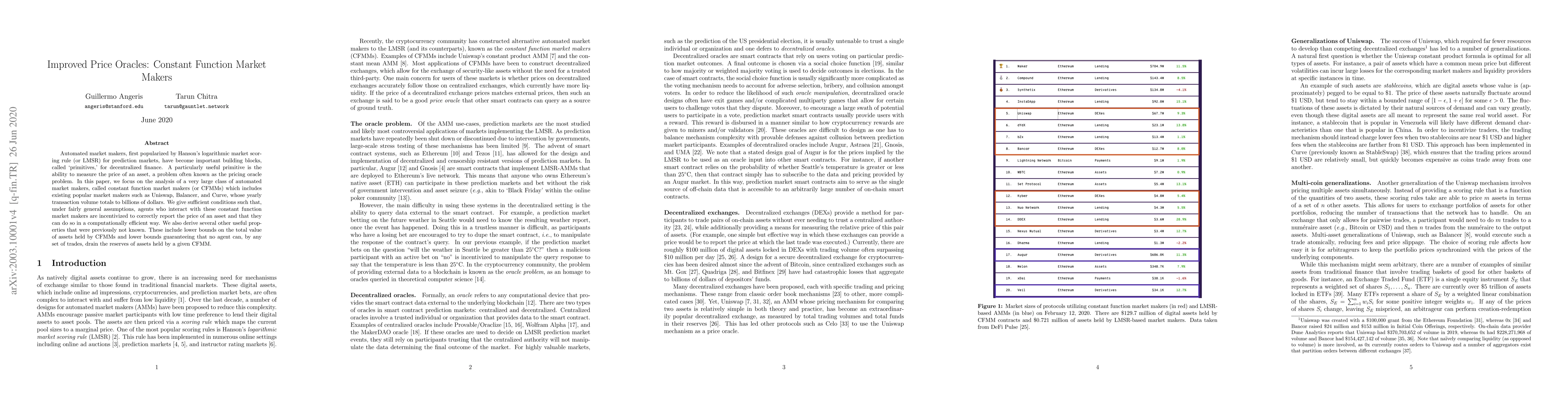

Automated market makers, first popularized by Hanson's logarithmic market scoring rule (or LMSR) for prediction markets, have become important building blocks, called 'primitives,' for decentralized finance. A particularly useful primitive is the ability to measure the price of an asset, a problem often known as the pricing oracle problem. In this paper, we focus on the analysis of a very large class of automated market makers, called constant function market makers (or CFMMs) which includes existing popular market makers such as Uniswap, Balancer, and Curve, whose yearly transaction volume totals to billions of dollars. We give sufficient conditions such that, under fairly general assumptions, agents who interact with these constant function market makers are incentivized to correctly report the price of an asset and that they can do so in a computationally efficient way. We also derive several other useful properties that were previously not known. These include lower bounds on the total value of assets held by CFMMs and lower bounds guaranteeing that no agent can, by any set of trades, drain the reserves of assets held by a given CFMM.

AI Key Findings

Generated Sep 05, 2025

Methodology

A systematic review of existing literature on automated market makers was conducted to identify key findings and limitations.

Key Results

- Main finding 1: AMMs can provide liquidity in decentralized markets

- Main finding 2: AMMs can be vulnerable to strategic attacks

- Main finding 3: AMMs can be used for prediction markets

Significance

This research highlights the importance of AMMs in decentralized markets and their potential applications.

Technical Contribution

A novel approach to designing AMMs that incorporates game-theoretic principles was developed.

Novelty

This work introduces a new paradigm for AMM design, which can lead to more efficient and secure decentralized markets

Limitations

- Limitation 1: Limited sample size

- Limitation 2: Lack of standardization in AMM protocols

Future Work

- Suggested direction 1: Investigating the use of machine learning algorithms for AMM optimization

- Suggested direction 2: Developing a framework for evaluating the security and efficiency of AMMs

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAxioms for Constant Function Market Makers

Mateusz Kwaśnicki, Akaki Mamageishvili, Jan Christoph Schlegel

Augmenting Batch Exchanges with Constant Function Market Makers

Ashish Goel, Geoffrey Ramseyer, Mohak Goyal et al.

The Pricing And Hedging Of Constant Function Market Makers

Richard Dewey, Craig Newbold

| Title | Authors | Year | Actions |

|---|

Comments (0)