Authors

Summary

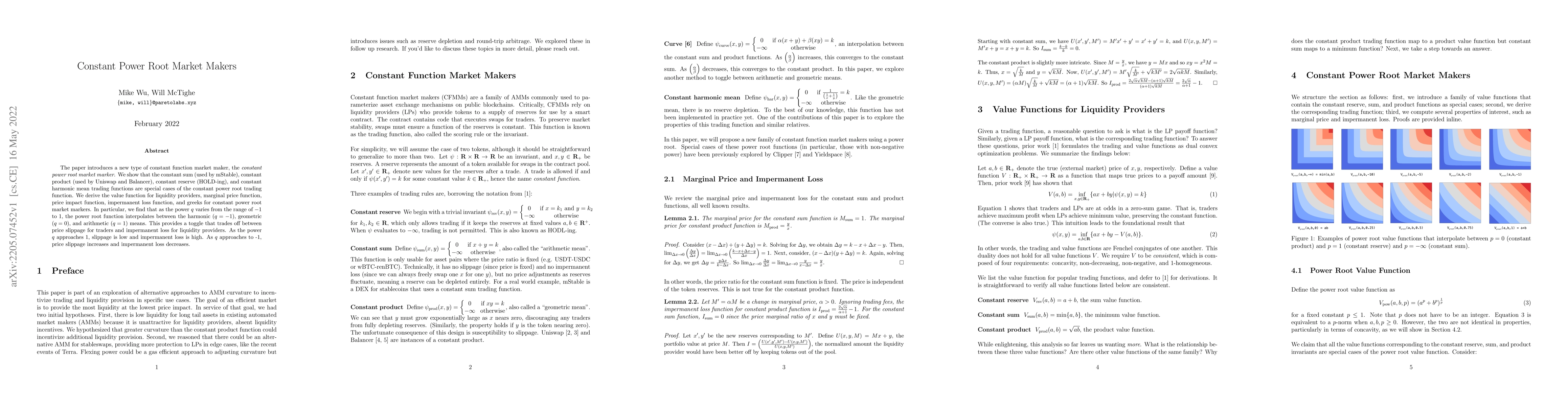

The paper introduces a new type of constant function market maker, the constant power root market marker. We show that the constant sum (used by mStable), constant product (used by Uniswap and Balancer), constant reserve (HOLD-ing), and constant harmonic mean trading functions are special cases of the constant power root trading function. We derive the value function for liquidity providers, marginal price function, price impact function, impermanent loss function, and greeks for constant power root market markers. In particular, we find that as the power q varies from the range of -infinity to 1, the power root function interpolates between the harmonic (q=-1), geometric (q=0), and arithmetic (q=1) means. This provides a toggle that trades off between price slippage for traders and impermanent loss for liquidity providers. As the power q approaches 1, slippage is low and impermanent loss is high. As q approaches to -1, price slippage increases and impermanent loss decreases.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAxioms for Constant Function Market Makers

Mateusz Kwaśnicki, Akaki Mamageishvili, Jan Christoph Schlegel

Mixing Constant Sum and Constant Product Market Makers

Alexander Port, Neelesh Tiruviluamala

| Title | Authors | Year | Actions |

|---|

Comments (0)