Authors

Summary

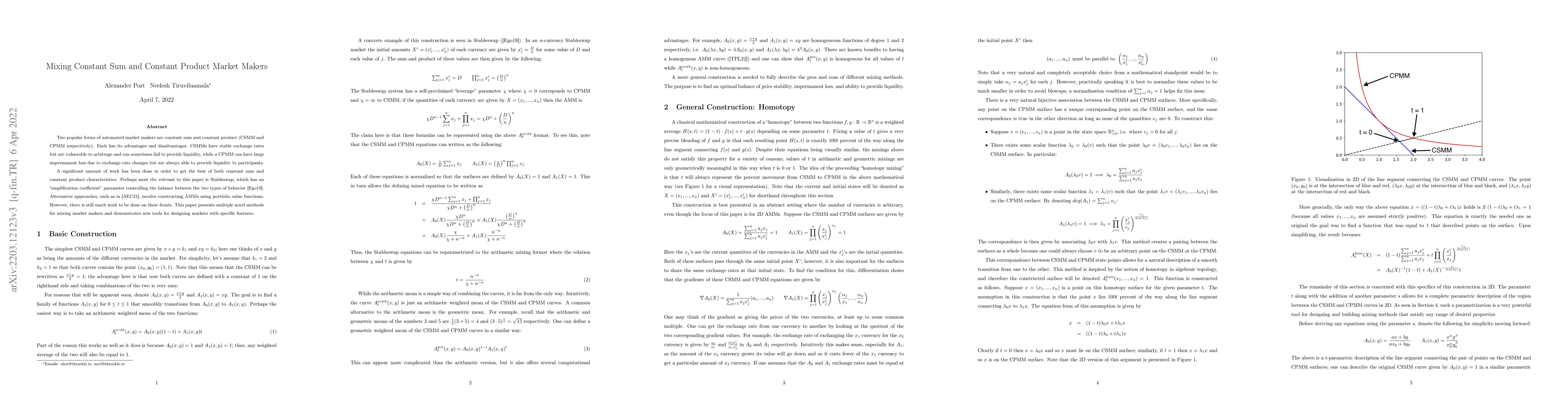

Two popular forms of automated market makers are constant sum and constant product (CSMM and CPMM respectively). Each has its advantages and disadvantages: CSMMs have stable exchange rates but are vulnerable to arbitrage and can sometimes fail to provide liquidity, while a CPMM can have large impermanent loss due to exchange rate changes but are always able to provide liquidity to participants. A significant amount of work has been done in order to get the best of both constant sum and constant product characteristics. Perhaps most the relevant to this paper is Stableswap, which has an "amplification coefficient" parameter controlling the balance between the two types of behavior [Ego19]. Alternative approaches, such as in [AEC21], involve constructing AMMs using portfolio value functions. However, there is still much work to be done on these fronts. This paper presents multiple novel methods for mixing market makers and demonstrates new tools for designing markets with specific features.

AI Key Findings

Generated Sep 05, 2025

Methodology

A novel method for blending the benefits of constant sum and constant product market makers is presented.

Key Results

- The non-uniform homotopy construction of a CSMM-to-CPMM blend opens many doors for designing interesting and intuitive AMM behavior.

- The homotopy construction gives a concrete geometric meaning to the blending weight.

- The λ(s,t) homotopy parametrization allows for very exact computations and prevents drift due to rounding errors.

Significance

This research provides a foundation for designing new classes of market makers with a wide variety of desired behaviors.

Technical Contribution

A novel method for constructing non-uniform homotopy markets is presented, allowing for a wide range of desired behaviors and improved stability.

Novelty

The use of homotopy parametrization and blending weights to create a new class of market makers with unique properties.

Limitations

- The current implementation may not be suitable for all market conditions or asset types.

- Further investigation is needed to fully understand the behavior of non-uniform homotopy markets.

Future Work

- Exploring the application of non-uniform homotopy markets in high-dimensional settings.

- Developing algorithms for dynamically adjusting the parameters of AMMs to maintain stable behavior under large external price changes.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAbout constant-product automated market makers

Théodore Conrad, Arthur Vinciguerra, Guillaume Méroué

Axioms for Constant Function Market Makers

Mateusz Kwaśnicki, Akaki Mamageishvili, Jan Christoph Schlegel

Decentralized Exchanges: The Profitability Frontier of Constant Product Market Makers

Tobias Bitterli, Fabian Schär

| Title | Authors | Year | Actions |

|---|

Comments (0)