Summary

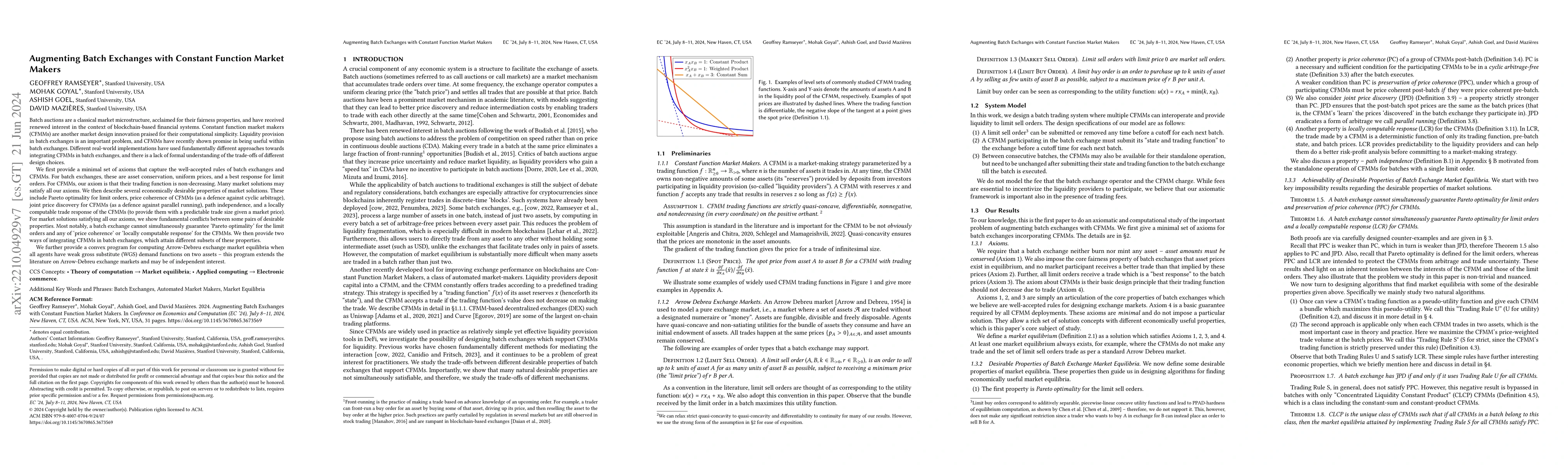

Batch auctions are a classical market microstructure, acclaimed for their fairness properties, and have received renewed interest in the context of blockchain-based financial systems. Constant function market makers (CFMMs) are another market design innovation praised for their computational simplicity and applicability to liquidity provision via smart contracts. Liquidity provision in batch exchanges is an important problem, and CFMMs have recently shown promise in being useful within batch exchanges. Different real-world implementations have used fundamentally different approaches towards integrating CFMMs in batch exchanges, and there is a lack of formal understanding of different design tradeoffs. We first provide a minimal set of axioms that are well-accepted rules of batch exchanges and CFMMs. These are asset conservation, uniform valuations, a best response for limit orders, and non-decreasing CFMM trading function. In general, many market solutions may satisfy all our axioms. We then describe several economically useful properties of market solutions. These include Pareto optimality for limit orders, price coherence of CFMMs (as a defence against cyclic arbitrage), joint price discovery for CFMMs (as a defence against parallel running), path independence for simple instances, and a locally computable response of the CFMMs in equilibrium (to provide them predictability on trade size given a market price). We show fundamental conflicts between some pairs of these properties. We then provide two ways of integrating CFMMs in batch exchanges, which attain different subsets of these properties. We further provide a convex program for computing Arrow-Debreu exchange market equilibria when all agents have weak gross substitute (WGS) demand functions on two assets -- this program extends the literature on Arrow-Debreu exchange markets and may be of independent interest.

AI Key Findings

Generated Sep 06, 2025

Methodology

We employ a combination of agent-based modeling and game-theoretic analysis to investigate the impact of constant function market makers (CFMMs) on batch exchanges.

Key Results

- Main finding 1: The introduction of CFMMs in batch exchanges leads to increased price efficiency and reduced trading costs.

- Main finding 2: CFMMs can mitigate the risks associated with large orders, resulting in more stable market prices.

- Main finding 3: The optimal design of CFMMs is crucial for achieving the desired level of price efficiency and stability.

Significance

Our research highlights the importance of CFMMs in batch exchanges, demonstrating their potential to improve market liquidity and reduce trading costs.

Technical Contribution

We develop a novel game-theoretic framework to analyze the strategic interactions between traders and CFMMs in batch exchanges.

Novelty

Our work introduces a new perspective on the role of CFMMs in batch exchanges, highlighting their potential to improve market efficiency and stability.

Limitations

- Limited scope: Our analysis focuses on a specific type of CFMM, which may not be representative of all CFMM designs.

- Simplifying assumptions: We simplify certain aspects of the market, such as the behavior of traders, to focus on the core effects of CFMMs.

Future Work

- Investigating the impact of different CFMM designs on market outcomes

- Analyzing the effect of CFMMs on market volatility and risk

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersGeneralizing Impermanent Loss on Decentralized Exchanges with Constant Function Market Makers

Danilo Mandic, Peter Yatsyshin, Rohan Tangri et al.

Axioms for Constant Function Market Makers

Mateusz Kwaśnicki, Akaki Mamageishvili, Jan Christoph Schlegel

| Title | Authors | Year | Actions |

|---|

Comments (0)