Summary

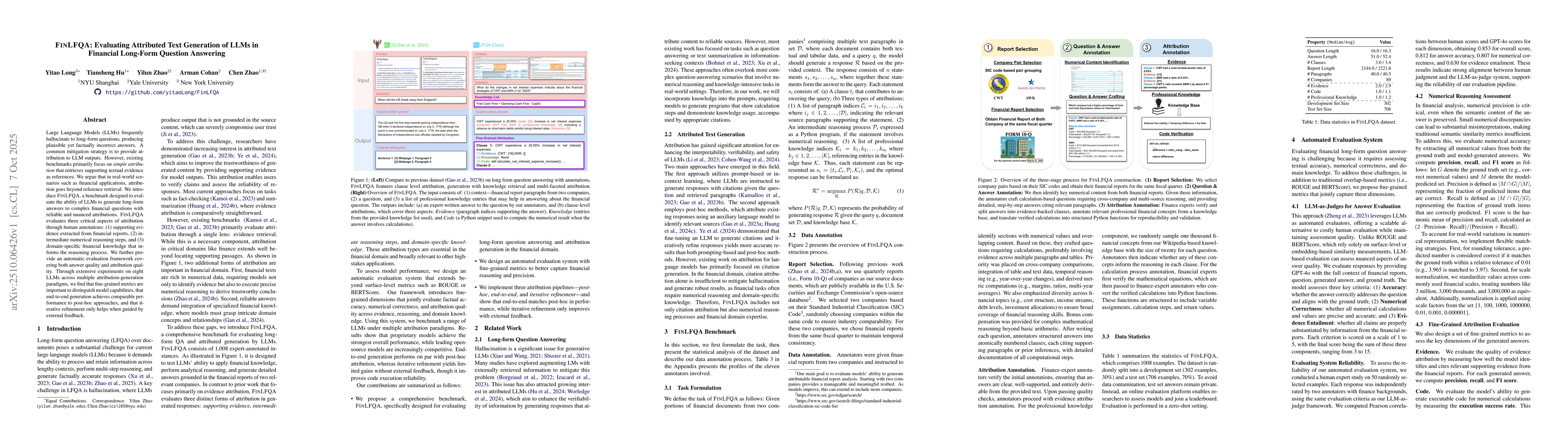

Large Language Models (LLMs) frequently hallucinate to long-form questions, producing plausible yet factually incorrect answers. A common mitigation strategy is to provide attribution to LLM outputs. However, existing benchmarks primarily focus on simple attribution that retrieves supporting textual evidence as references. We argue that in real-world scenarios such as financial applications, attribution goes beyond reference retrieval. We introduce FinLFQA, a benchmark designed to evaluate the ability of LLMs to generate long-form answers to complex financial questions with reliable and nuanced attributions. FinLFQA evaluates three critical aspects of attribution through human annotations: (1) supporting evidence extracted from financial reports, (2) intermediate numerical reasoning steps, and (3) domain-specific financial knowledge that informs the reasoning process. We further provide an automatic evaluation framework covering both answer quality and attribution quality. Through extensive experiments on eight LLMs across multiple attribution-generation paradigms, we find that fine-grained metrics are important to distinguish model capabilities, that end-to-end generation achieves comparable performance to post-hoc approaches, and that iterative refinement only helps when guided by external feedback.

AI Key Findings

Generated Oct 11, 2025

Methodology

This study evaluates the performance of large language models (LLMs) in financial analysis tasks, including end-to-end generation, iterative refinement, and post-hoc attribution generation. The models are tested on financial reports and questions, with metrics such as ROUGE-L, BERTScore, and numerical correctness measured across different settings.

Key Results

- GPT-4o achieves the highest overall performance across all metrics, including 51.0% attribution performance and 4.6/5 LLM-as-a-judge score.

- Qwen2.5-72B and Llama-3.3-70B show strong performance, with Qwen2.5-72B achieving 40.9% attribution performance and 4.4/5 LLM-as-a-judge score.

- Smaller models like Llama-3.2-1B and Mistral-8x22B exhibit significantly lower performance, indicating the importance of model scale in financial analysis tasks.

Significance

This research highlights the potential of LLMs in automating complex financial analysis tasks, which could improve efficiency and reduce human error in financial reporting and decision-making processes.

Technical Contribution

The study introduces a comprehensive framework for evaluating LLMs in financial analysis, including end-to-end generation, iterative refinement, and post-hoc attribution generation, along with detailed error analysis and categorization.

Novelty

This work is novel in its systematic evaluation of multiple LLM approaches for financial analysis tasks, combined with detailed error analysis that identifies specific issues such as code errors, evidence attribution errors, and knowledge validation errors.

Limitations

- The study is limited to a specific set of financial reports and questions, which may not represent real-world scenarios fully.

- The evaluation metrics focus on textual and numerical accuracy but may not capture all aspects of financial analysis quality.

Future Work

- Expanding the dataset to include a wider variety of financial reports and scenarios.

- Developing more sophisticated evaluation metrics that account for both accuracy and contextual understanding in financial analysis.

- Investigating the integration of domain-specific knowledge into LLM training to improve financial analysis capabilities.

Paper Details

PDF Preview

Similar Papers

Found 4 papersFinTextQA: A Dataset for Long-form Financial Question Answering

Jian Chen, Junwei Liang, Peilin Zhou et al.

Evaluating LLMs' Mathematical Reasoning in Financial Document Question Answering

Vivek Gupta, Dan Roth, Tanuja Ganu et al.

Investigating Answerability of LLMs for Long-Form Question Answering

Ye Liu, Yingbo Zhou, Rui Meng et al.

What Factors Affect LLMs and RLLMs in Financial Question Answering?

Peng Wang, Jiageng Wu, Dagang Li et al.

Comments (0)