Summary

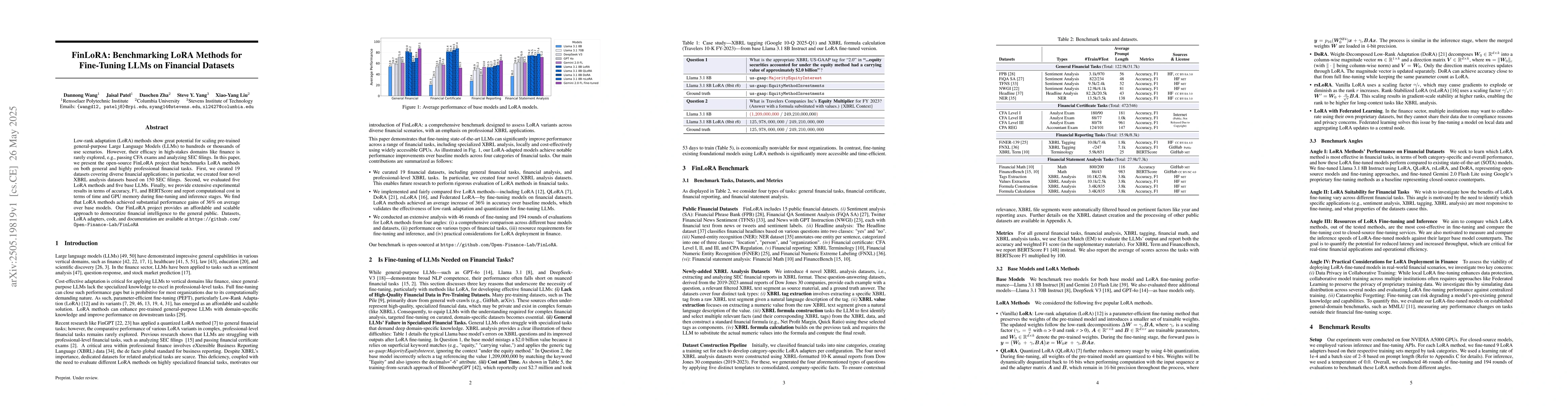

Low-rank adaptation (LoRA) methods show great potential for scaling pre-trained general-purpose Large Language Models (LLMs) to hundreds or thousands of use scenarios. However, their efficacy in high-stakes domains like finance is rarely explored, e.g., passing CFA exams and analyzing SEC filings. In this paper, we present the open-source FinLoRA project that benchmarks LoRA methods on both general and highly professional financial tasks. First, we curated 19 datasets covering diverse financial applications; in particular, we created four novel XBRL analysis datasets based on 150 SEC filings. Second, we evaluated five LoRA methods and five base LLMs. Finally, we provide extensive experimental results in terms of accuracy, F1, and BERTScore and report computational cost in terms of time and GPU memory during fine-tuning and inference stages. We find that LoRA methods achieved substantial performance gains of 36\% on average over base models. Our FinLoRA project provides an affordable and scalable approach to democratize financial intelligence to the general public. Datasets, LoRA adapters, code, and documentation are available at https://github.com/Open-Finance-Lab/FinLoRA

AI Key Findings

Generated Jun 07, 2025

Methodology

The paper curated 19 datasets covering diverse financial applications, including four novel XBRL analysis datasets based on 150 SEC filings. It evaluated five LoRA methods and five base LLMs, providing extensive results in terms of accuracy, F1, and BERTScore, along with computational cost during fine-tuning and inference stages.

Key Results

- LoRA methods achieved substantial performance gains of 36% on average over base models.

- FinLoRA project offers an affordable and scalable approach for fine-tuning LLMs on financial datasets.

Significance

This research is important as it explores the efficacy of LoRA methods in high-stakes finance domains, which are rarely examined, and aims to democratize financial intelligence to the general public.

Technical Contribution

FinLoRA, an open-source project benchmarking LoRA methods for fine-tuning LLMs on financial datasets, providing datasets, LoRA adapters, code, and documentation.

Novelty

This work is novel by focusing on applying LoRA methods to financial datasets, creating new XBRL analysis datasets, and benchmarking various LoRA techniques for financial intelligence tasks.

Limitations

- The study did not explore the long-term stability or generalizability of LoRA methods beyond the fine-tuning stage.

- Limited to English language financial datasets and SEC filings, potentially overlooking other important financial data sources.

Future Work

- Investigate the long-term performance and generalizability of LoRA methods in financial applications.

- Expand the dataset scope to include more diverse financial data sources and languages.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLoRAFusion: Efficient LoRA Fine-Tuning for LLMs

Shang Wang, Qidong Su, Gennady Pekhimenko et al.

LowRA: Accurate and Efficient LoRA Fine-Tuning of LLMs under 2 Bits

Qizheng Zhang, Kunle Olukotun, Zikai Zhou et al.

CLoQ: Enhancing Fine-Tuning of Quantized LLMs via Calibrated LoRA Initialization

Aozhong Zhang, Zi Yang, Naigang Wang et al.

A Comparative Analysis of Instruction Fine-Tuning LLMs for Financial Text Classification

Yuheng Hu, Sorouralsadat Fatemi, Maryam Mousavi

No citations found for this paper.

Comments (0)