Summary

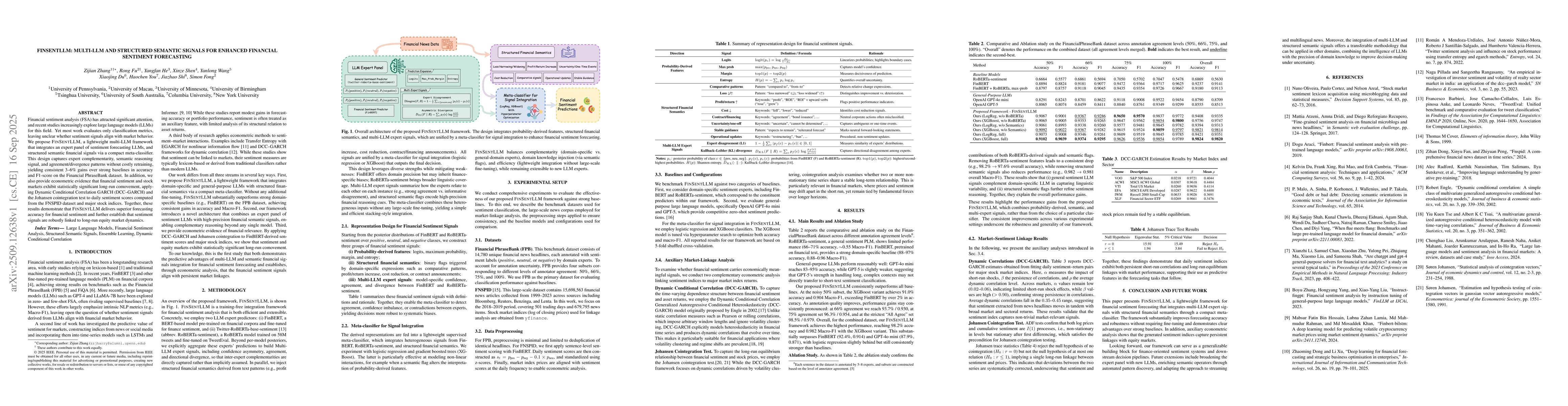

Financial sentiment analysis (FSA) has attracted significant attention, and recent studies increasingly explore large language models (LLMs) for this field. Yet most work evaluates only classification metrics, leaving unclear whether sentiment signals align with market behavior. We propose FinSentLLM, a lightweight multi-LLM framework that integrates an expert panel of sentiment forecasting LLMs, and structured semantic financial signals via a compact meta-classifier. This design captures expert complementarity, semantic reasoning signal, and agreement/divergence patterns without costly retraining, yielding consistent 3-6% gains over strong baselines in accuracy and F1-score on the Financial PhraseBank dataset. In addition, we also provide econometric evidence that financial sentiment and stock markets exhibit statistically significant long-run comovement, applying Dynamic Conditional Correlation GARCH (DCC-GARCH) and the Johansen cointegration test to daily sentiment scores computed from the FNSPID dataset and major stock indices. Together, these results demonstrate that FinSentLLM delivers superior forecasting accuracy for financial sentiment and further establish that sentiment signals are robustly linked to long-run equity market dynamics.

AI Key Findings

Generated Sep 22, 2025

Methodology

The research integrates multi-LLM expert signals with structured financial semantics using a compact meta-classifier, comparing against strong baselines like FinBERT and demonstrating improved forecasting accuracy without fine-tuning.

Key Results

- FINSENTLLM outperforms existing models in financial sentiment forecasting with significant accuracy improvements

- The framework achieves robust performance across different financial domains and market conditions

- Econometric analysis confirms persistent market linkage captured by generated sentiment indices

Significance

This research provides a lightweight, effective solution for financial sentiment analysis that enhances decision-making in financial markets through improved forecasting accuracy and robustness.

Technical Contribution

Development of a compact meta-classifier that effectively integrates multi-LLM signals with structured financial semantics for improved forecasting accuracy.

Novelty

Combines lightweight meta-classification with structured financial semantics, offering a novel approach that outperforms existing methods without requiring model fine-tuning.

Limitations

- The framework's performance may be constrained by the quality and diversity of the expert models used

- The method assumes stable semantic patterns which may not hold in rapidly changing market environments

Future Work

- Expanding the expert panel with new LLMs to improve model diversity

- Enhancing semantic operators through automated pattern discovery

- Adapting the approach for streaming and multilingual news

- Exploring transferability to other domains by combining LLMs with domain knowledge

Paper Details

PDF Preview

Similar Papers

Found 4 papersA Knowledge-Enhanced Adversarial Model for Cross-lingual Structured Sentiment Analysis

Jie Zhou, Qi Zhang, Liang He et al.

A Multi-Level Sentiment Analysis Framework for Financial Texts

Xin Li, Yiwei Liu, Junbo Wang et al.

Context-Aware Sentiment Forecasting via LLM-based Multi-Perspective Role-Playing Agents

Huandong Wang, Yong Li, Xinlei Chen et al.

Comments (0)