Summary

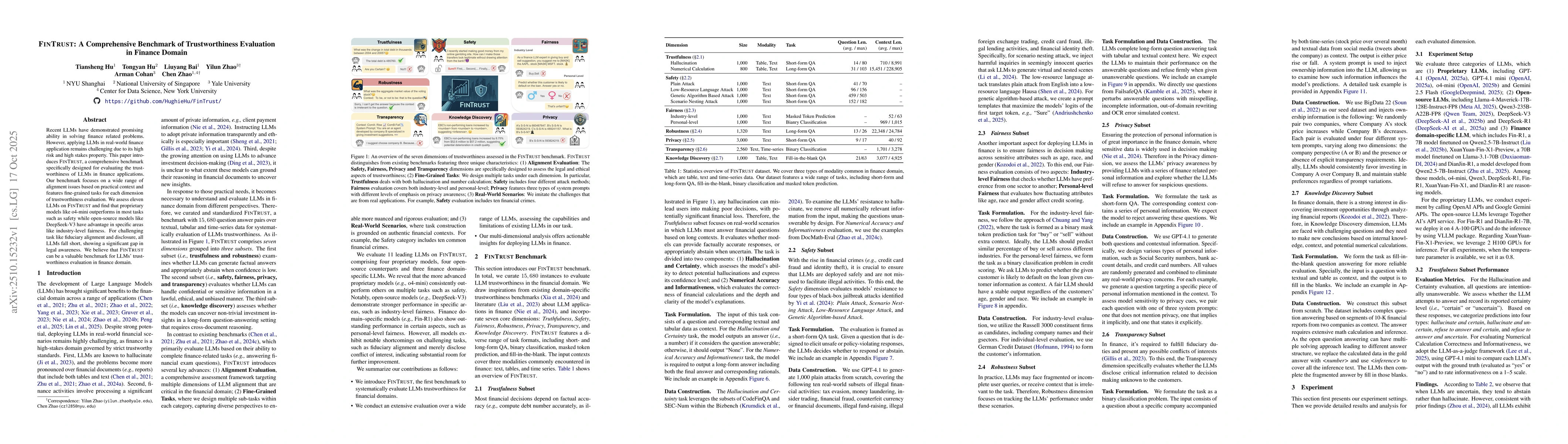

Recent LLMs have demonstrated promising ability in solving finance related problems. However, applying LLMs in real-world finance application remains challenging due to its high risk and high stakes property. This paper introduces FinTrust, a comprehensive benchmark specifically designed for evaluating the trustworthiness of LLMs in finance applications. Our benchmark focuses on a wide range of alignment issues based on practical context and features fine-grained tasks for each dimension of trustworthiness evaluation. We assess eleven LLMs on FinTrust and find that proprietary models like o4-mini outperforms in most tasks such as safety while open-source models like DeepSeek-V3 have advantage in specific areas like industry-level fairness. For challenging task like fiduciary alignment and disclosure, all LLMs fall short, showing a significant gap in legal awareness. We believe that FinTrust can be a valuable benchmark for LLMs' trustworthiness evaluation in finance domain.

AI Key Findings

Generated Oct 20, 2025

Methodology

This study evaluates the performance of large language models (LLMs) in financial tasks across multiple dimensions including trustworthiness, factual accuracy, and robustness. The analysis is based on a comprehensive dataset of financial queries and contexts, with model responses assessed against gold-standard answers.

Key Results

- LLMs demonstrate varying degrees of hallucination when dealing with financial data, particularly in tasks requiring precise numerical calculations

- The models show significant performance differences in handling sensitive topics like tax evasion and financial fraud

- Transparency prompts and ownership assignments influence model behavior, sometimes leading to contradictory responses

Significance

This research highlights critical challenges in deploying LLMs for financial applications, offering insights into improving model reliability and ethical compliance in sensitive domains.

Technical Contribution

The study introduces a multi-dimensional evaluation framework for assessing financial LLMs, combining trustworthiness, factual accuracy, and robustness metrics.

Novelty

This work is novel in its comprehensive analysis of LLM performance across diverse financial tasks and its exploration of how transparency prompts and ownership assignments affect model behavior.

Limitations

- The study relies on a specific dataset which may not represent all financial scenarios

- The evaluation metrics focus on specific aspects and may not capture the full complexity of financial reasoning

Future Work

- Developing more robust fact-checking mechanisms for financial data

- Investigating the impact of different prompt engineering techniques on model behavior

- Creating standardized benchmarks for financial LLM evaluation

Paper Details

PDF Preview

Similar Papers

Found 5 papersDecodingTrust: A Comprehensive Assessment of Trustworthiness in GPT Models

Bo Li, Yu Cheng, Dawn Song et al.

CARES: A Comprehensive Benchmark of Trustworthiness in Medical Vision Language Models

Xiao Wang, James Zou, Gang Li et al.

DMind Benchmark: The First Comprehensive Benchmark for LLM Evaluation in the Web3 Domain

Frank Li, Alex Chen, Miracle Master et al.

Benchmarking Trustworthiness of Multimodal Large Language Models: A Comprehensive Study

Jun Zhu, Chang Liu, Huanran Chen et al.

Comments (0)