Authors

Summary

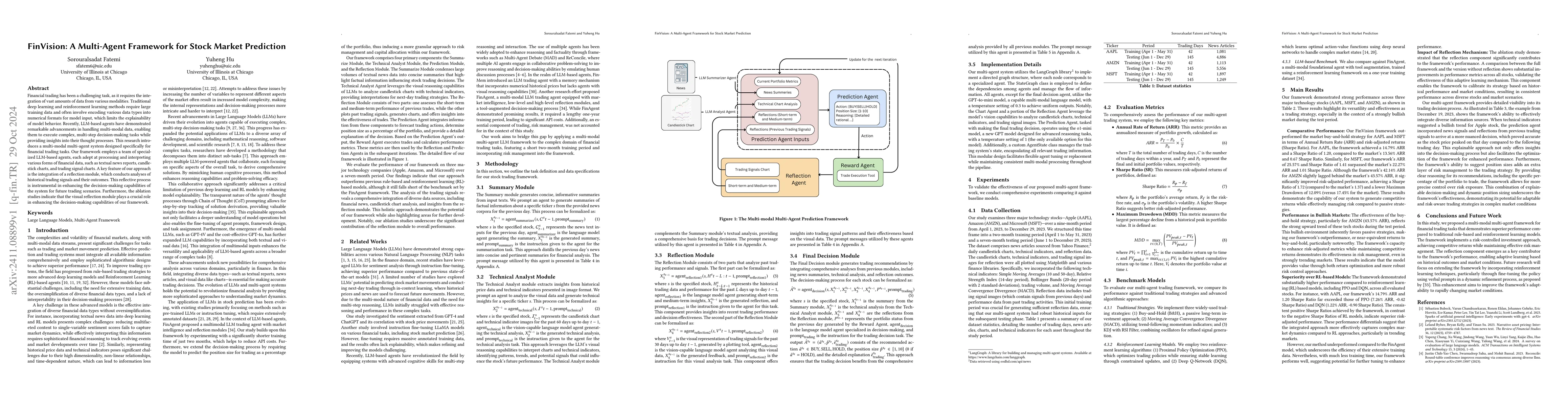

Financial trading has been a challenging task, as it requires the integration of vast amounts of data from various modalities. Traditional deep learning and reinforcement learning methods require large training data and often involve encoding various data types into numerical formats for model input, which limits the explainability of model behavior. Recently, LLM-based agents have demonstrated remarkable advancements in handling multi-modal data, enabling them to execute complex, multi-step decision-making tasks while providing insights into their thought processes. This research introduces a multi-modal multi-agent system designed specifically for financial trading tasks. Our framework employs a team of specialized LLM-based agents, each adept at processing and interpreting various forms of financial data, such as textual news reports, candlestick charts, and trading signal charts. A key feature of our approach is the integration of a reflection module, which conducts analyses of historical trading signals and their outcomes. This reflective process is instrumental in enhancing the decision-making capabilities of the system for future trading scenarios. Furthermore, the ablation studies indicate that the visual reflection module plays a crucial role in enhancing the decision-making capabilities of our framework.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersElliottAgents: A Natural Language-Driven Multi-Agent System for Stock Market Analysis and Prediction

Jarosław A. Chudziak, Michał Wawer

FinMamba: Market-Aware Graph Enhanced Multi-Level Mamba for Stock Movement Prediction

Yifan Hu, Shu-Tao Xia, Tao Dai et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)