Authors

Summary

We investigate model risk distributionally robust sensitivities for functionals on the Wasserstein space when the underlying model is constrained to the martingale class and/or is subject to constraints on the first marginal law. Our results extend the findings of Bartl, Drapeau, Obloj \& Wiesel \cite{bartl2021sensitivity} and Bartl \& Wiesel \cite{bartlsensitivityadapted} by introducing the minimization of the distributionally robust problem with respect to semi-static hedging strategies. We provide explicit characterizations of the model risk (first order) optimal semi-static hedging strategies. The distributional robustness is analyzed both in terms of the adapted Wasserstein metric and the more relevant standard Wasserstein metric.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

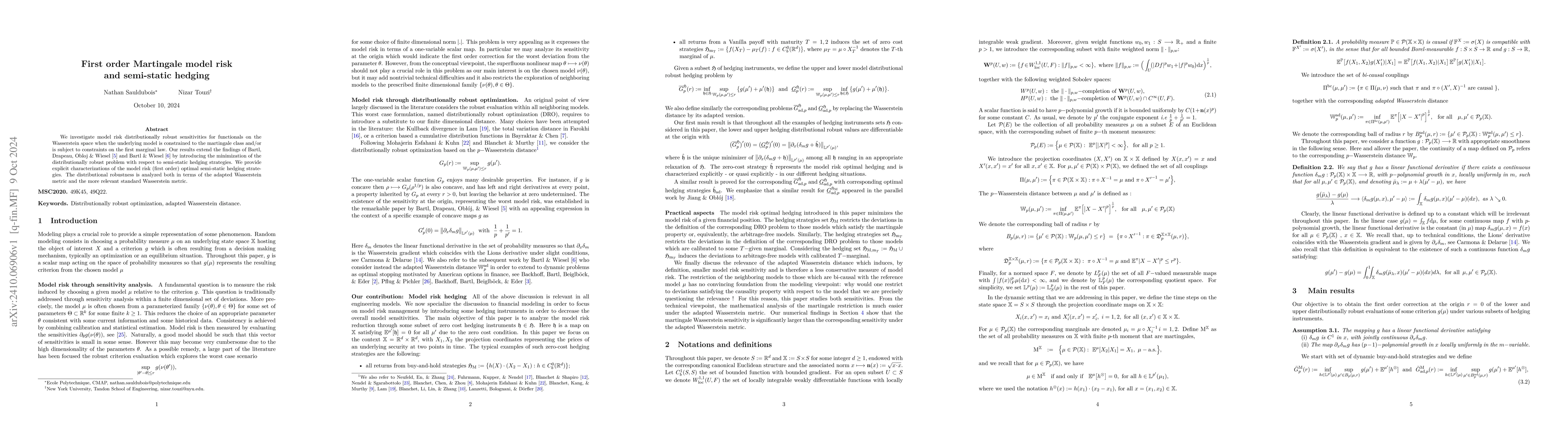

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)