Summary

With model uncertainty characterized by a convex, possibly non-dominated set of probability measures, the agent minimizes the cost of hedging a path dependent contingent claim with given expected success ratio, in a discrete-time, semi-static market of stocks and options. Based on duality results which link quantile hedging to a randomized composite hypothesis test, an arbitrage-free discretization of the market is proposed as an approximation. The discretized market has a dominating measure, which guarantees the existence of the optimal hedging strategy and helps numerical calculation of the quantile hedging price. As the discretization becomes finer, the approximate quantile hedging price converges and the hedging strategy is asymptotically optimal in the original market.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

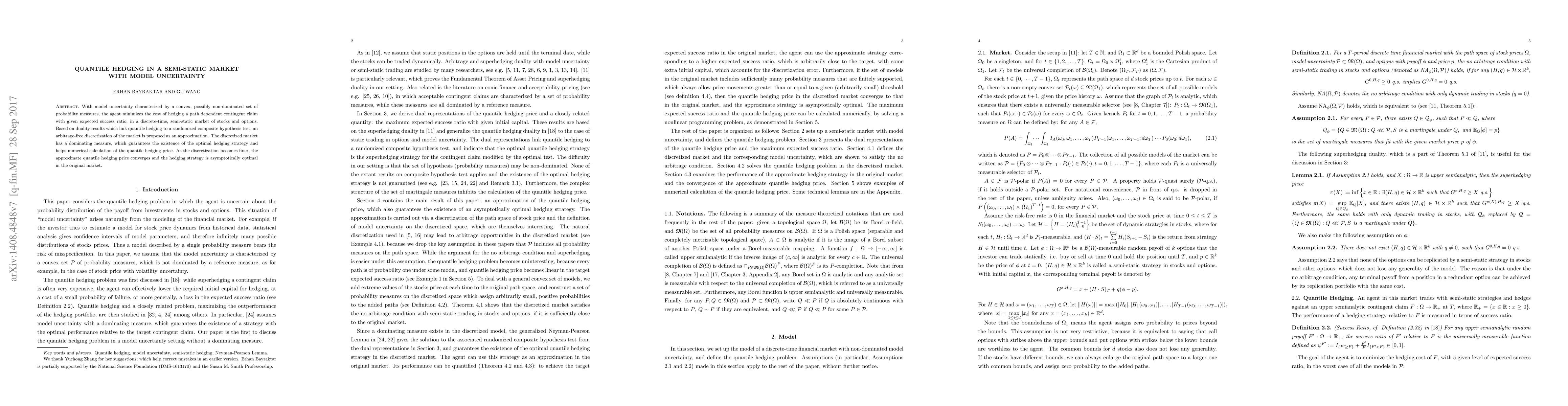

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)